DEA CAPITAL S.p.A.

Registered Office at Via Brera, 21 - 20121 Milan

Share Capital of Euro 306,612,100 fully paid up

Tax Code, VAT reg. no. and Milan Register of Companies no. 07918170015

Notice of

Shareholders’

Meeting

DeA Capital - Annual Financial Statements to 31 December 2013

1

DeA Capital

S.p.A.

DeA Capital S.p.A.

Registered Office at Via Brera 21, 20121 Milan

Share capital of EUR 306,612,100, fully paid up

Tax Code, VAT reg. no. and Milan Register of Companies no. 07918170015,

Milan REA (Administrative Economic Register) 1833926

Company subject to the management and co-ordination of De Agostini S.p.A.

NOTICE OF SHAREHOLDERS' MEETING

All eligible persons are invited to attend the Ordinary and Extraordinary Shareholders' Meetings to be held at

Spazio Chiossetto, Via Chiossetto 20, Milan:

- at 11 a.m. on Thursday, 17 April 2014, on first call;

- at 11 a.m. on Friday, 18 April 2014, on second call:

to discuss and resolve upon the following.

AGENDA

Ordinary shareholders’ meeting

1. Approval of the financial statements for the year ended 31 December 2013. Related and consequent

resolutions. Presentation of the consolidated financial statements of the Group headed by DeA

Capital S.p.A. for the year ended 31 December 2013.

2. Authorisation to acquire and dispose of treasury shares. Related and consequent resolutions.

3. Approval of a performance share plan for certain employees, and/or directors with specific duties,

of DeA Capital S.p.A., the companies it controls and its parent company, as well as a stock option

plan reserved for certain employees of DeA Capital S.p.A., the companies it controls and its parent

company. Related and consequent resolutions.

4. Presentation of the DeA Capital S.p.A. Remuneration Report and advisory vote by the shareholders’

meeting on the Remuneration Policy of DeA Capital S.p.A. (section I of the Remuneration Report),

in accordance with Art. 123-ter of Legislative Decree no. 58 of 24 February 1998, as subsequently

amended and supplemented.

Extraordinary shareholders’ meeting

1. A share capital increase, against payment, in tranches and without option rights, pursuant to

Art. 2441, paragraph 8, of the Italian Civil Code for a total amount of EUR 2,000,000 by issuing a

maximum of 2,000,000 shares, reserved solely and irrevocably for subscription by the beneficiaries

of the 2014-2016 Stock Option Plan. Consequent amendment to Art. 5 of the articles of association.

Related and consequent resolutions.

* * *

Presentation of proposals for deliberation/incorporation into the agenda

Members representing, including jointly, at least 2.5% of the share capital may submit a request, within ten

days of this notice being published (i.e. by 28 March 2014), for items to be incorporated into the meeting

agenda, indicating on the request the topics suggested, and may also submit proposals for deliberation

regarding items already on the agenda.

The request, together with the share ownership certificate issued, pursuant to the regulations in force, by

the authorised intermediaries holding the ledgers in which the shareholders’ shares are registered, must

be submitted in writing, by hand or by recorded-delivery and by the above deadline, to the company’s

registered office, for the attention of the Investor Relations department, or sent by electronic mail to the

submitting the request (a contact telephone number should also be provided). Shareholders submitting

such requests must also provide, by the same deadline and by the same means, a report setting out the

reasons for the proposed deliberation of new items or further proposals for deliberation of items already

on the agenda. The company is responsible for notifying shareholders of the incorporation into the meeting

agenda of any new items or proposals for deliberations on existing items, in the same form as for the

publication of this notice convening shareholders’ meetings, at least fifteen days before the scheduled first-

call meeting date. At the same time as publication of the notice confirming incorporation into the agenda

of new items or proposals for deliberations on existing items, the proposals for incorporation/deliberation,

together with the corresponding reports submitted by the members concerned and any opinion of the Board

of Directors, must be made public pursuant to Art. 125-ter, paragraph 1, of Legislative Decree no. 58/1998.

With the exception of proposals relating to the subject areas listed in Art. 125-ter, paragraph 1, of

Legislative Decree no. 58/1998, no additions may be made to the agenda if they relate to matters which,

by law, must be decided by the shareholders’ meeting at the proposal of the Board of Directors or on the

basis of a plan or report prepared by the same.

Right to ask questions about items on the agenda

All holders of voting rights may raise questions about items on the agenda, including in advance of the

meeting. Any questions, together with the share ownership certificate issued, pursuant to the regulations

in force, by the authorised intermediaries holding the ledgers in which shareholders’ shares are registered,

must be sent to the company’s registered office for the attention of the Investor Relations department, by

recorded-delivery letter, by fax to the number +39 02 62499599 or by email to the address

[email protected]. Questions must be received by the company before close of business on the third day

before the scheduled meeting date (i.e. by 14 April 2014). Provided that questions are received before

the meeting and by the requisite deadline, a response will be provided, at the latest, during the meeting

itself; a response is deemed to have been provided at a meeting if it is made available, on paper, to

each of those entitled to vote at the start of the meeting. The company may provide a single response to

questions with the same content. The company also reserves the right to provide the information requested

by any questions received prior to the shareholders’ meeting by displaying it on a dedicated “Questions

Governance/Shareholders’ Meetings). Where this is the case, no response needs be given at the meeting.

Right to take part in meetings

Shareholders are eligible to take part in shareholders’ meetings if they are registered as holding voting

rights on the record date - i.e. by the close of business on the seventh trading day before the date

scheduled for the first-call meeting (8 April 2014) - and if the requisite statement has been received from

the authorised intermediary by the company. Individuals who only become shareholders after that date will

not be entitled to take part or vote in the shareholders’ meeting.

The statement by the authorised intermediary referred to above must be received by the company before

close of business on the third trading day prior to the date scheduled for the first-call meeting. If the

statement is received by the company after this date, shareholders will, however, still be entitled to take

part in the meeting and vote provided the statement is received before the start of the first-call meeting.

It should be remembered that the statement is communicated to the company by the authorised

intermediary at the request of the individual holding the voting right.

Representation in meetings

All those entitled to take part in a meeting may appoint a representative by issuing a written proxy in

accordance with the statutory and regulatory provisions in force. In this regard, note that a proxy may be

granted by means of a digital document in electronic form, as defined in Art. 135-novies, paragraph 6, of

Legislative Decree no. 58/1998, and that the proxy-letter template provided at www.deacapital.it may be

used for this purpose. The company may be notified of the proxy via recorded-delivery letter,

sent to the company’s registered office or via email to the company’s certified email address at

If the proxy holder provides or sends a copy of the proxy to the company instead of the original, he/she

must certify, on his/her own responsibility, that it is a true copy and confirm the proxy- giver's identity. Any

advance notification does not release the proxy holder from the obligation to certify that the proxy is a true

copy and to attest to the identity of the proxy-giver when he/she confirms his/her eligibility to take part in

the shareholders’ meeting.

Designated proxy holder

Proxies, with voting instructions for the items on the agenda, may be granted to Computershare S.p.A.,

which has its registered office at Via Lorenzo Mascheroni 19, Milan 20145, duly designated by the company

for this purpose, in accordance with Art. 135-undecies of Legislative Decree 58/1998; a printable version

of the relevant form to be signed may be downloaded from the website www.deacapital.it (under the

section Corporate Governance/Shareholders’ Meetings) or obtained from the company’s registered office

or from the registered office of Computershare S.p.A. The original of the proxy, with voting instructions,

must be received by Computershare S.p.A., Via Lorenzo Mascheroni 19, Milan 20145, by close of business

on the penultimate trading day before the date scheduled for the first-call meeting or for any second-call

meeting (i.e. by 15 April 2014 for the first-call meeting or by 16 April 2014 for the second-call meeting).

A copy of the proxy, accompanied by a statement confirming that it is a true copy of the original, may be

provided to the designated proxy holder by the above-mentioned deadlines by fax to +39 (0)2 46776850,

in respect of those items for which voting instructions are given. Proxies and voting instructions may be

revoked by the deadlines specified above. Note that the statement to be communicated to the company

by the authorised intermediary, confirming the shareholder’s eligibility to take part and exercise his voting

rights in the shareholders’ meeting, is also required if a proxy is granted to the designated proxy holder. By

law, shares for which a proxy is granted, whether in full or in part, are taken into account in determining

whether the shareholders’ meeting is duly constituted, although proxies without voting instructions do not

count for the purposes of calculating the majority and quorum required to pass resolutions. Details of the

proxies granted to Computershare S.p.A. (who can be contacted for any queries by telephone on

+39 (0)2 46776811) are also available on the relevant delegation form mentioned above.

Share capital and voting shares

The share capital is EUR 306,612,100 divided into 306,612,100 ordinary shares each with a par value of

EUR 1.00. Each ordinary share carries voting rights at the shareholders’ meeting (except ordinary treasury

shares, which currently total 32,637,004, on which voting rights are suspended in accordance with

the law).

Documentation and information

Please note that documentation relating to the items on the agenda that is required by law or under

regulatory provisions will be made available to the public at the company’s registered office and published

as well as by the means and under the terms and conditions laid down in the regulations in force;

shareholders and other parties entitled to take part in shareholders’ meetings may obtain copies of this

documentation.

The following, in particular, will be made available to the public:

- at the same time as the publication of this notice, the Directors’ Report on point 3 of the ordinary part

and the detailed documentation required pursuant to Art. 84-bis of the Issuer Regulations

- the financial report and other documents referred to in Art. 154-ter of the TUF, together with the

directors’ reports on the other items on the agenda, to be made available at least 21 days before the

scheduled meeting date (i.e. 27 March 2014).

All eligible persons have the right to read and, on request, obtain a copy thereof.

***

Milan, 18 March 2014

For the Board of Directors.

The Chairman

(Lorenzo Pellicioli)

“An abstract of the above Notice was published on MF on 18 March 2014”

Corporate Boards

Corporate information

and Controlling

DeA Capital S.p.A. is subject to the management and co-ordination of

De Agostini S.p.A.

Structure

Registered office: Via Brera 21, Milan 20121, Italy.

Share capital: EUR 306,612,100 (fully paid-up) comprising 306,612,100

shares with a nominal value of EUR 1 each (including 32,637,004 own

shares at 31 December 2013).

Tax code, VAT code and recorded in the Milan Register of Companies

under no. 07918170015.

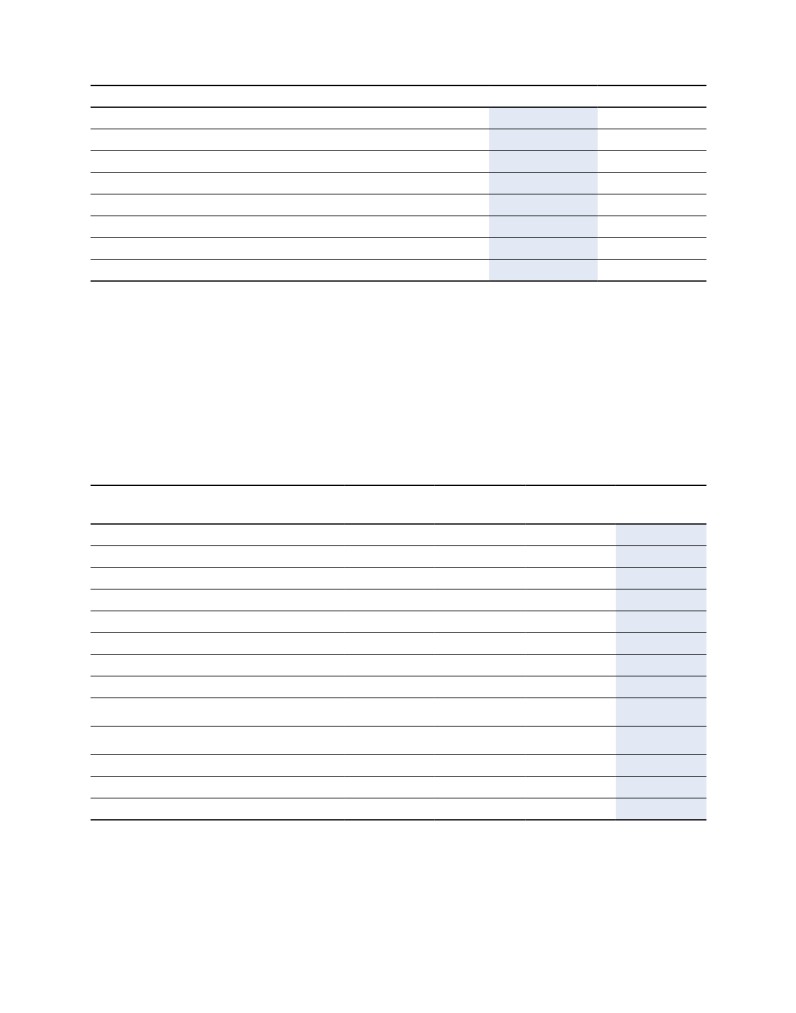

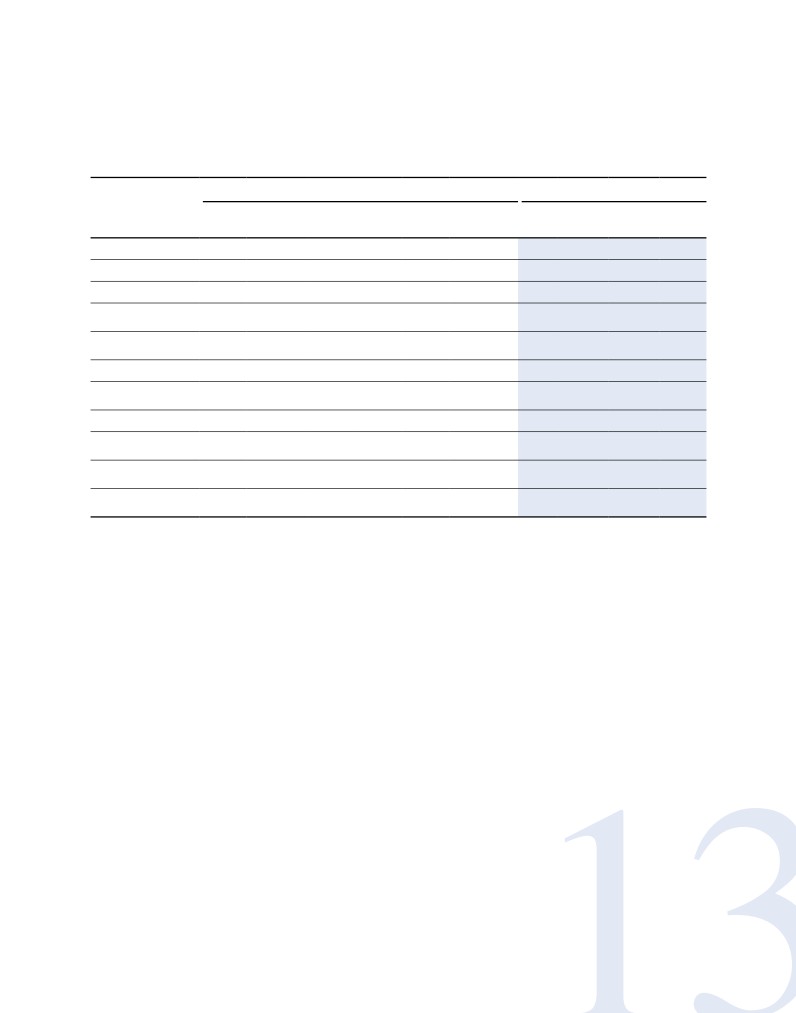

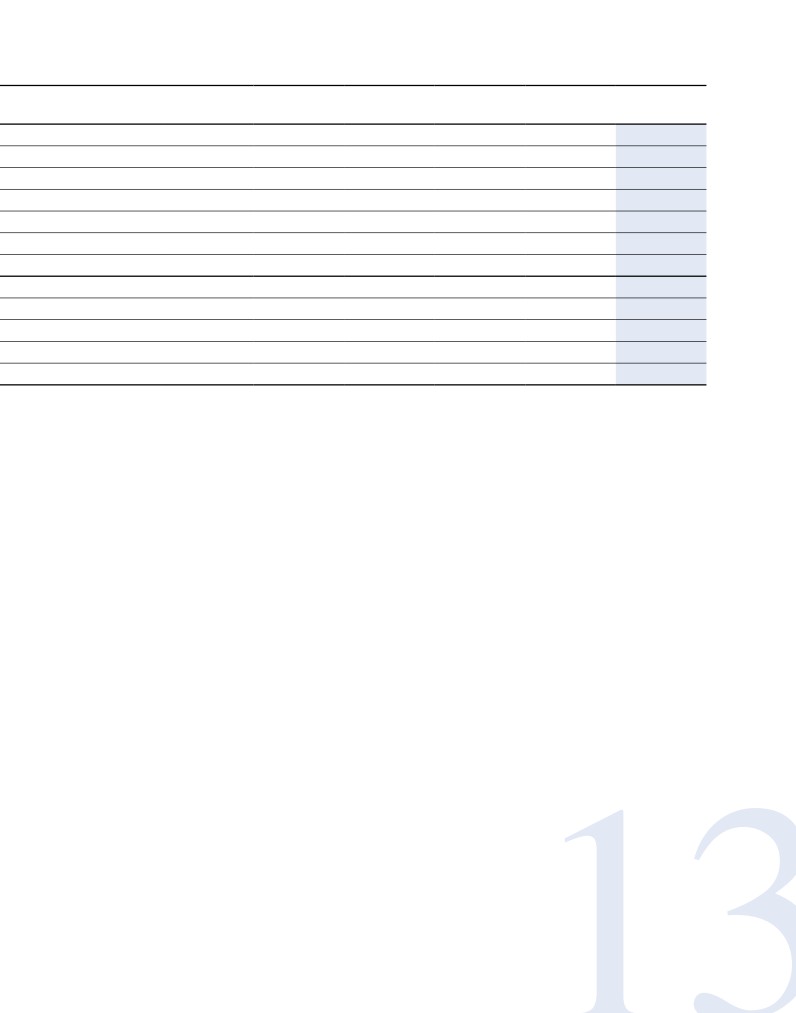

Board of Directors (*)

Chairman

Lorenzo Pellicioli

Chief Executive Officer

Paolo Ceretti

Directors

Lino Benassi

Rosario Bifulco (1 / 4 / 5)

Marco Boroli

Stefania Boroli

Marco Drago

Roberto Drago

Francesca Golfetto (1 / 3 / 5)

Severino Salvemini (2 / 3 / 5)

Board of Statutory Auditors (*)

Chairman

Angelo Gaviani

Regular Auditors

Gian Piero Balducci

Annalisa Raffaella Donesana

Alternate Auditors

Annamaria Esposito Abate

Maurizio Ferrero

Giulio Gasloli

Secretariat of the Board of Directors

Diana Allegretti

Manager responsible for preparing the Company’s accounts

Manolo Santilli

Independent Auditors

KPMG S.p.A.

(*) In office until the approval of the financial statements to 31 December 2015

(1) Member of the Control and Risk Committee

(2) Member and Chairman of the Control and Risk Committee

(3) Member of the Remuneration and Appointments Committee

(4) Member and Chairman of the Remuneration and Appointments Committee

(5) Independent director

DeA Capital - Annual Financial Statements to 31 December 2013

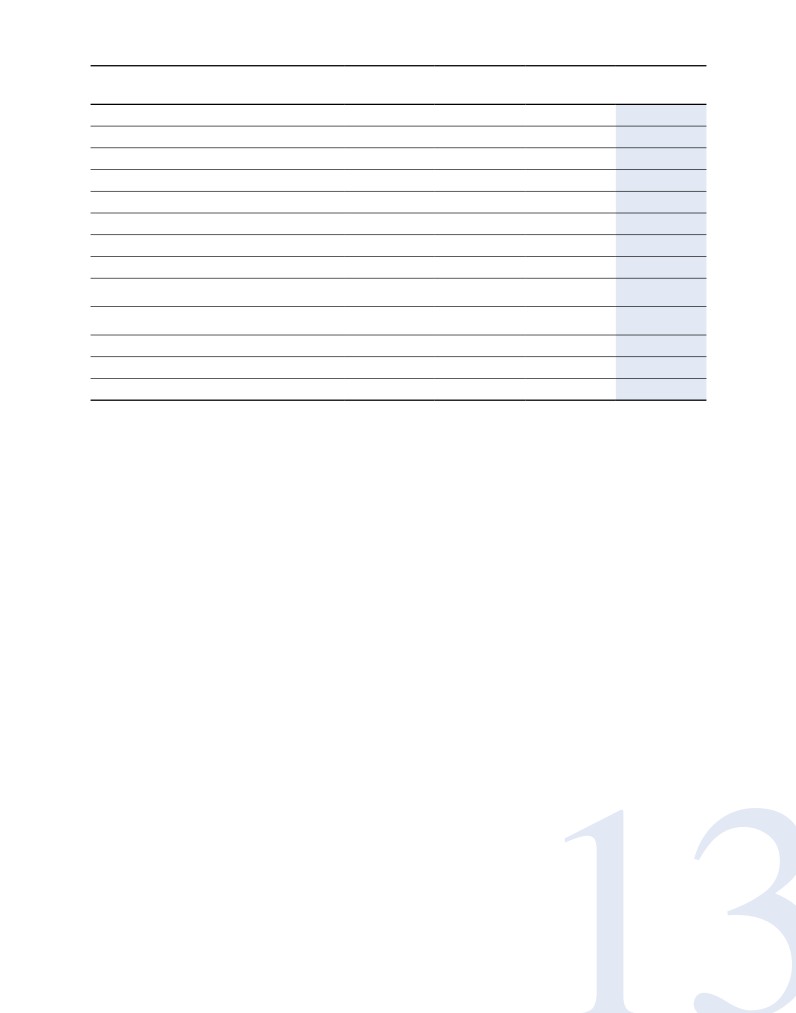

7

Letter to the Shareholders

10

Report on Operations

13

1. Profile of DeA Capital S.p.A.

14

2. Information for Shareholders

18

3. The DeA Capital Group’s key Statement of Financial Position

C

ontents

and Income Statement figures

21

4. Significant events during the year

22

5. The results of the DeA Capital Group

26

6. Results of the Parent Company DeA Capital S.p.A.

64

7. Other information

67

8. Proposal to approve the financial statements of DeA Capital S.p.A.

for the year ending 31 December 2013 and related

and resulting resolutions

77

Consolidated financial statements for the

year ending 31 December 2013

79

Statement of responsibilities for the consolidated

financial statements pursuant to art. 154-bis

of Legislative Decree 58/98

141

Information pursuant to art. 149-duodecies

of the Consob Issuer Regulations -

Consolidated financial statements

143

Annual financial statements for the year

ending 31 December 2013

145

Statement of responsibilities for accounts

pursuant to art. 154-bis of Legislative

Decree 58/98

193

Information pursuant to art. 149-duodecies

of the Consob Issuer Regulation -

annual financial statements

195

Summary of subsidiaries’ financial statements

to 31 December 2013

197

Independent Auditors’ Report

201

Report of the Board of Statutory Auditors

207

DeA Capital - Annual Financial Statements to 31 December 2013

9

Letter

“Overall, the Alternative Asset

Management asset portfolio generated

returns of around EUR 95 million,

with dividends of EUR 16.6 million

(compared with EUR 15.0 million in

2012) distributed to DeA Capital and to

the intermediate holding companies.”

“… in Private Equity Investments

DeA Capital will continue to seek

opportunities for enhancing

the value of its holdings.”

10 DeA Capital - Letter to the Shareholders

to the Shareholders

D

ear shareholders,

in Europe, the year 2013 was marked by

With reference to the latter, the subsidiary Générale

persistently restrained economic growth, with all

de Santé, completed the sale of its psychiatric

countries adhering to policies aimed at maintaining

division at the end of December, which enabled it to

balanced budgets. At the same time, spreads

further concentrate on its core business of medical,

generally fell among both government and corporate

surgical and obstetric clinics and also to significantly

securities, while the stock markets’ performance

reduce its debt.

was highly positively, in Italy as in other countries

of the European Union.

On the Alternative Asset Management front, DeA

Capital has strengthened Innovation Real Estate, a

Against this backdrop, the value of DeA Capital's

primary independent operator in property, facility

investment portfolio, which is significantly

& project management, with an acquisition that

concentrated in the economies of countries other

has made possible an extraordinary increase in

than Italy and had for that reason better withstood,

turnover, and has continued to develop IDeA Capital

over recent years, the economic/financial crisis that

Funds SGR through the launch of a number of

hit our country, has almost returned to its level as

rather innovative major initiatives in the offering of

of the end of 2011: its NAV closed at EUR 2.30 on

private equity funds.

31 December 2013, compared with the EUR 2.63

per share at the end of 2012, a movement largely

Overall, the Alternative Asset Management

attributable to the stock market performance of the

asset portfolio generated returns of around EUR

investment in Migros and the devaluation of the

95 million, with dividends of EUR 16.6 million

Turkish lira.

(compared with EUR 15.0 million in 2012)

distributed to DeA Capital and to the intermediate

Migros, which continues to achieve excellent results

holding companies.

compared with the rest of the industry, was hit

by unexpected political instability in Turkey from

There was continued positive performance on

May 2013 onwards; this instability prompted many

the financial markets as 2014 began, although

international institutional investors to move their

macroeconomic prospects remain uncertain,

capital elsewhere, reflecting the more generally

especially in Italy.

reduced exposure to emerging economies.

The prospect, then, is of a year in which Alternative

Apart from realigning the value of its investment

Asset Management will continue to find fundraising

in Migros, DeA Capital has also revised the

on the domestic market slow and difficult, while in

development projections and hence the goodwill, of

Private Equity Investments DeA Capital will continue

IDeA FIMIT SGR using more prudential criteria; the

to seek opportunities for enhancing the value of its

situation in the real estate sector remains complex,

holdings.

in that, despite a number of timid signs of recovery

in transaction volumes - buoyed up by renewed

interest from foreign investors in particular - there

is a significant concentration of funds due to mature

in the next couple of years, with the need to sell

off assets potentially putting sale prices under

pressure. With this prospect in view, it is to be

Lorenzo Pellicioli

Paolo Ceretti

hoped that solutions facilitating the orderly disposal

Chairman

Chief Executive Officer

of assets may be found, including by means of

legislation and regulation.

During the year that has just ended, DeA Capital

has continued to focus on developing its operations

in the Alternative Asset Management sector

and on enhancing the value of its Private Equity

investments.

DeA Capital - Annual Financial Statements to 31 December 2013

11

Report on

Operations

DeA Capital - Annual Financial Statements to 31 December 2013

13

Profile of

With an investment portfolio of over EUR 760 million and assets

under management of EUR 10,500 million, DeA Capital S.p.A. is

one of Italy’s largest alternative investment operators.

The Company, which operates in both the Private Equity

Investment and Alternative Asset Management businesses,

is listed on the FTSE Italia STAR section of the Milan stock

exchange, and heads the De Agostini Group in the area

of financial investments.

In the Private Equity Investment business, DeA Capital S.p.A.

has "permanent" capital, and therefore has the advantage -

compared with traditional private equity funds, which are

normally restricted to a pre-determined duration - of greater

flexibility in optimising the timing of entry to and exit from

investments. In terms of investment policy, this flexibility allows

it to adopt an approach based on value creation over

the medium to long term.

In the Alternative Asset Management business, DeA Capital

S.p.A. - through its subsidiaries IDeA FIMIT SGR and IDeA

Capital Funds SGR - is Italy’s leading operator in real estate

fund management and private equity funds of funds programmes,

respectively. The two companies are active in the promotion,

management and value enhancement of investment funds, using

approaches based on sector experience and the ability to identify

opportunities for achieving the best returns.

As Alternative Asset Management focuses on managing funds

with a medium-term to long-term duration, it generates cash

flows that are relatively stable over time for DeA Capital

S.p.A. This, in turn, enables the Company to cover the typical

investment cycle of the private equity investment sector.

14 DeA Capital - Profile of DeA Capital S.p.A.

DeA Capital S.p.A.

PRIVATE EQUITY INVESTMENT

Direct investments

In the services sector, in Europe and

Emerging Europe.

Indirect investments

In private equity funds of funds, co-investment

funds and theme funds.

ALTERNATIVE ASSET

MANAGEMENT

IDeA Capital Funds SGR,

which manages private equity funds (funds of

funds, co-investment funds and theme funds)

1.3 Mld €

Assets under management: EUR 1.3 billion

IDeA FIMIT SGR,

which manages real estate funds.

Asset Under Management: EUR 9,2 billion

9.2 Mld €

IRE / IRE Advisory,

which operates in project, property and facility

management, as well as real estate brokerage

For further info:

section: Portfolio

DeA Capital - Annual Financial Statements to 31 December 2013

15

At 31 December 2013, DeA Capital S.p.A. reported Group

company Kenan Investments S.A., an investment recorded in

consolidated shareholders’ equity of EUR 629.5 million (EUR

the AFS portfolio of the DeA Capital Group (with a stake

723.1 million at 31 December 2012), corresponding to a net

of 17.03%).

asset value (NAV) of EUR 2.30 per share (EUR 2.63 per

share at 31 December 2012), with an investment portfolio

- strategic shareholding in Sigla, which provides consumer

of EUR 762.0 million (EUR 873.1 million at

credit for non-specific purposes (salary-backed loans and

31 December 2012).

personal loans) and services non-performing loans in Italy. The

investment is held through the Luxembourg-registered company

More specifically, the investment portfolio, which consists

Sigla Luxembourg S.A., an associate of the DeA Capital Group

of private equity investments of EUR 367.2 million, private

(with a stake of 41.39%).

equity investment funds of EUR 191.3 million and net assets

relating to the Alternative Asset Management business of

• Funds

EUR 203.5 million.

- units in four funds managed by the subsidiary IDeA Capital

Funds SGR i.e. in the funds of funds IDeA I Fund of Funds

Investiment portfolio

(IDeA I FoF) and ICF II, in the co-investment fund IDeA

December 31, 2013

Opportunity Fund I (IDeA OF I) and in the theme fund

IDeA Efficienza Energetica e Sviluppo Sostenibile (Energy

n.

Eur/mln.

Efficiency and Sustainable Development - IDeA EESS);

Equity investments

8

367.2

Funds

12

191.3

- a unit in the real estate fund Atlantic Value Added (AVA)

managed by IDeA FIMIT SGR;

Private Equity Investment

20

558.5

Alternative Asset Management (*)

4

203.5

- units in seven venture capital funds.

Investment portfolio

24

762.0

(*) Equity investments in subsidiaries relating to Alternative

Asset Management are valued using the equity method in

ALTERNATIVE ASSET MANAGEMENT

this table.

- controlling interest in IDeA Capital Funds SGR

(100%), which manages private equity funds (funds of

PRIVATE EQUITY INVESTMENT

funds, co-investment funds and theme funds) with about

EUR 1.3 billion in assets under management and five

• Main investments

managed funds;

- strategic shareholding in Générale de Santé (GDS),

- controlling interest in IDeA FIMIT SGR (64.30% at

France's leading private healthcare provider, whose shares

31 December 2013), Italy's largest independent real

are listed on the Eurolist market in Paris (with around

estate asset management company with about EUR 9.2

5% in outstanding shares and low trading volumes). The

billion in assets under management and 32 managed

investment is held through the Luxembourg-registered

funds (including five listed funds);

company Santé S.A., an associate of the DeA Capital Group

(with a stake of 42.89%).

- controlling stake (83.65%) in IRE/IRE Advisory, which

operate in project, property and facility management, as well

- minority shareholding in Migros, Turkey's biggest food retail

as real estate brokerage.

chain, whose shares are listed on the Istanbul Stock Exchange.

The investment is held through the Luxembourg-registered

16 DeA Capital - Profile of DeA Capital S.p.A.

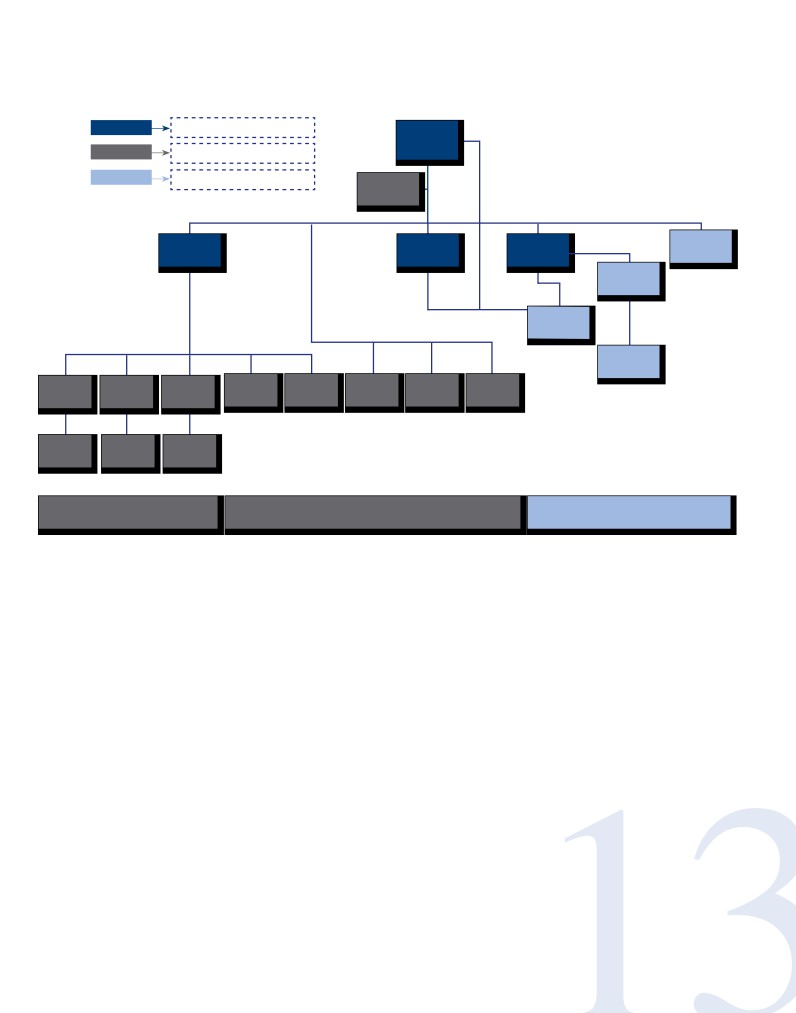

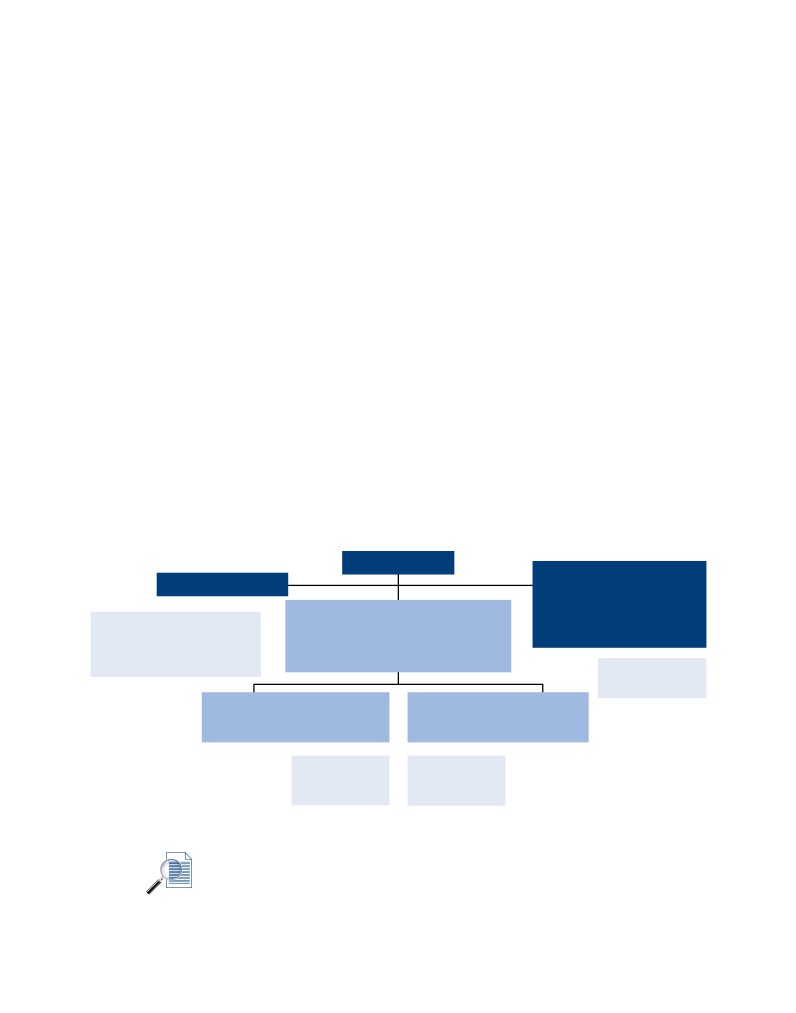

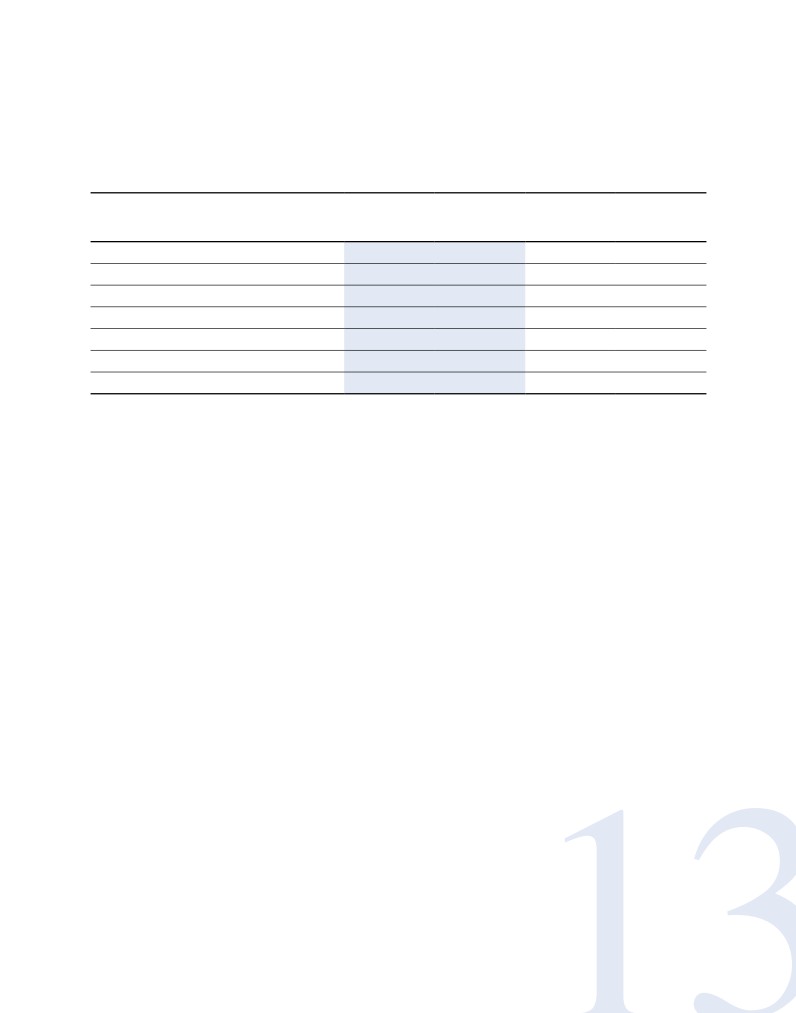

At the end of 2013, the corporate structure of the Group headed by DeA Capital S.p.A. (DeA Capital Group, or the Group) was as

summarised below:

Holding Companies

DeA Capital

S.p.A.

3.00%

Private Equity Investment

Alternative Asset Management

Funds and other

100%

Shareholdings

100%

100%

100%

IDeA

DeA Capital

83.65%(*)

DeA Capital

Capital Funds

Investments S.A.

IFIM

Real Estate

SGR

(Luxembourg)

IRE

40.32%

20.98%

IDeA FIMIT

SGR

100%

IRE

Advisory

Quota

Quota

Quota

Shareholding

Shareholding

Quota

Quota

Shareholding

Kenan

Sigla

IDeA

IDeA I

IDeA

Santé

AVA

ICF II

Investments

Luxembourg

OF I

Fund of Funds

EESS

Shareholding

Shareholding

Shareholding

GDS

Migros

Sigla

Private Equity

Private Equity Investment

Alternative

Investment “Direct”

“Indirect”

Asset Management

(*) Considering special shares, with limited economic rights, for approximately 10% of the company.

DeA Capital - Annual Financial Statements to 31 December 2013

17

Information for

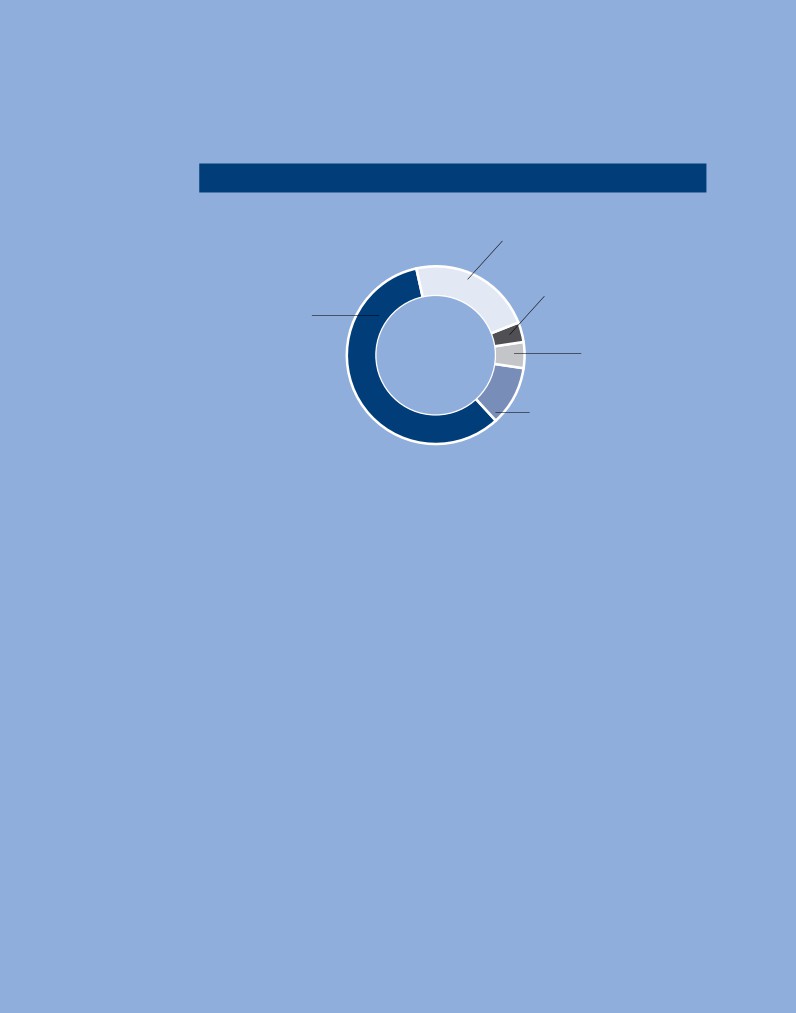

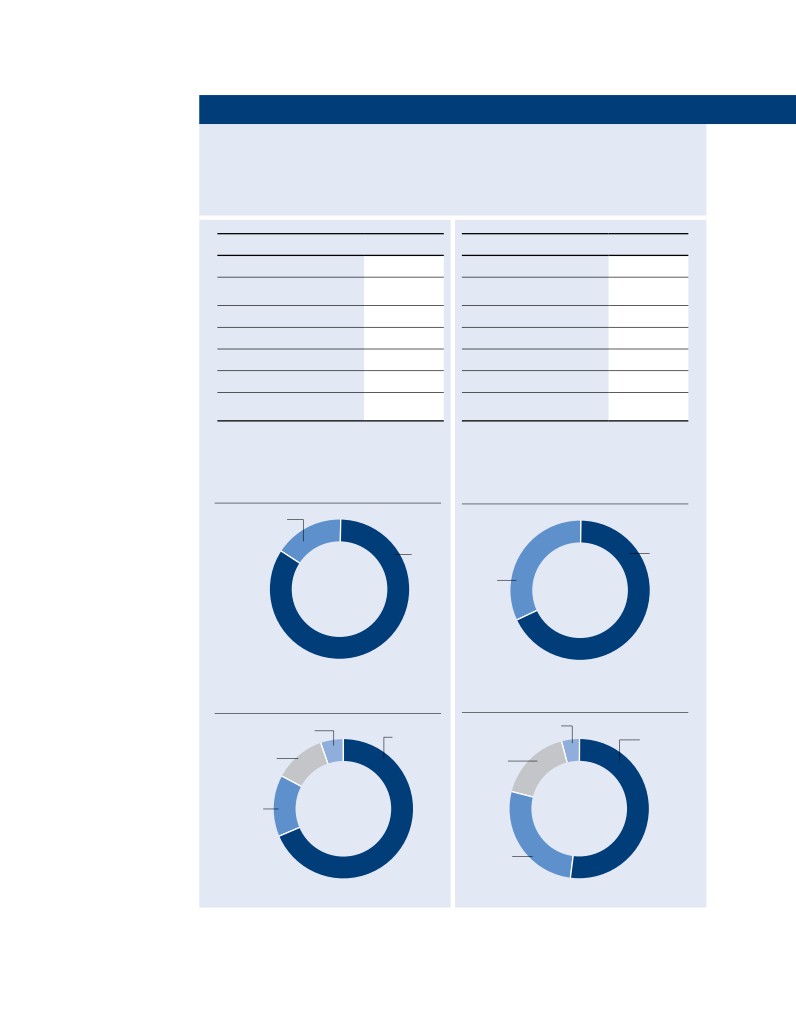

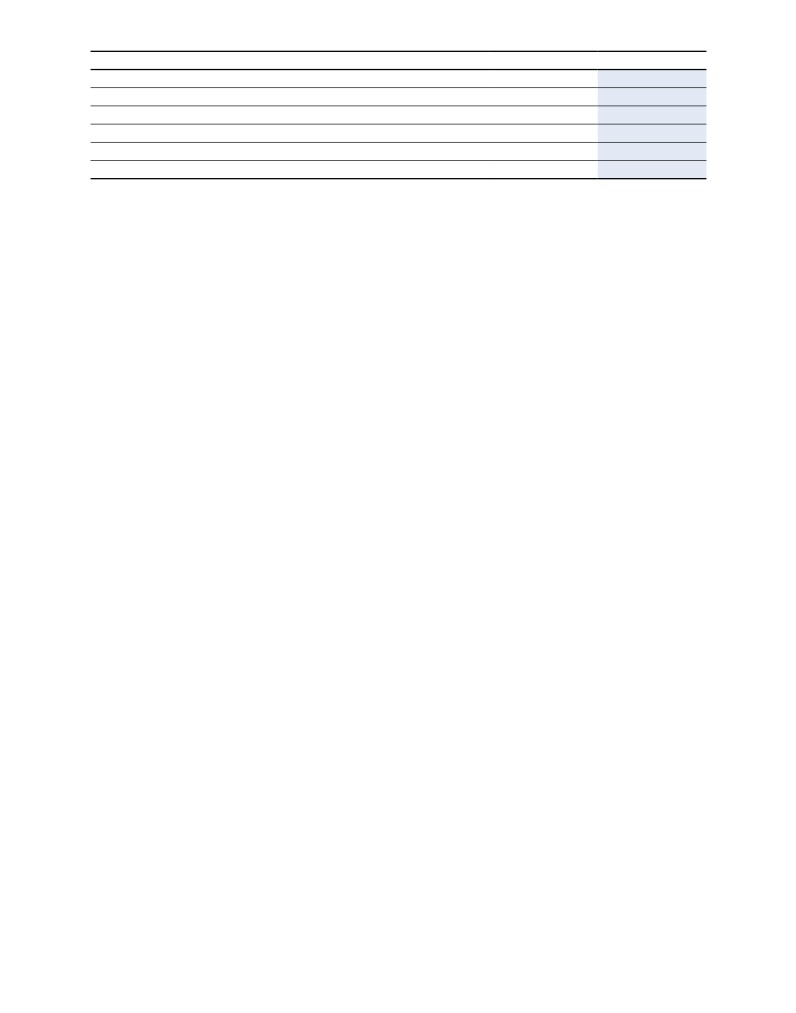

SHAREHOLDER STRUCTURE - DEA CAPITAL S.P.A. (#)

22.5

%

Free float

3.8

%

58.3

%

DEB Holding

De Agostini S.p.A.

4.8

%

Mediobanca

10.6

%

Treasury stock

(#) Figures to 31 December 2013.

18 DeA Capital - Information for shareholders

shareholders

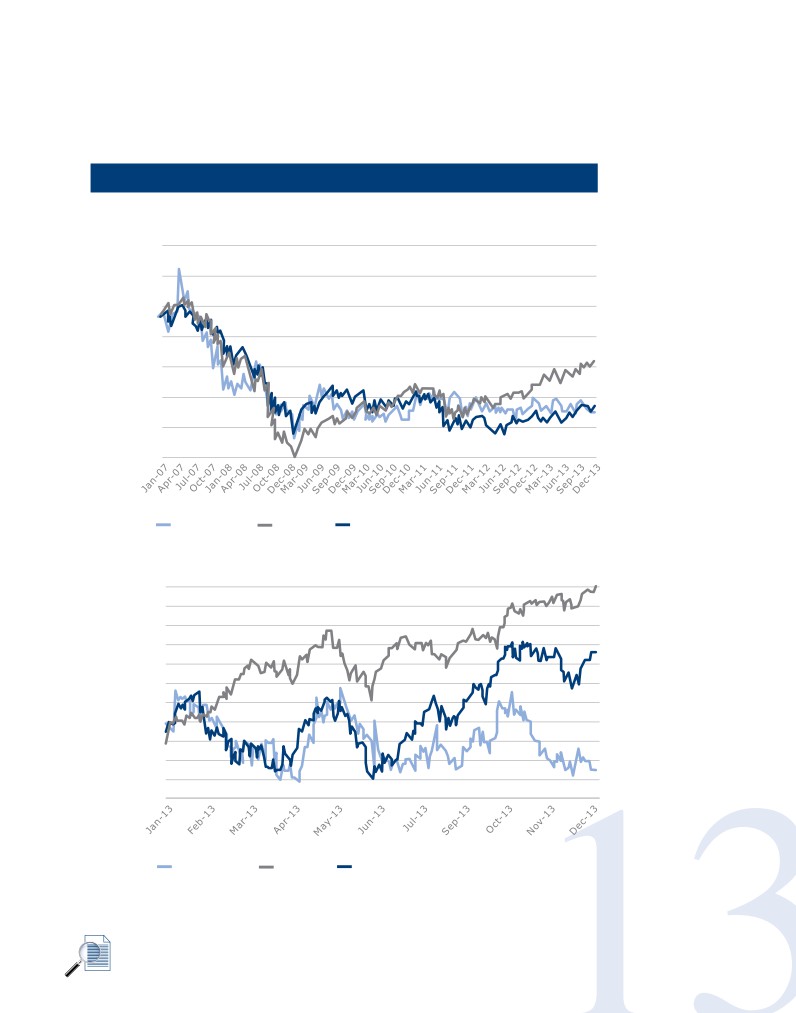

SHARE PERFORMANCE **

Period from 11 January 2007, when DeA Capital S.p.A. began operations, to 31 December 2013.

4,0

3,5

3,0

2,5

2,0

1,5

1,0

0,5

DeA Capital

LPX 50

FTSE All

Period from 1 January 2013 to 31 December 2013

1,75

1,70

1,65

1,60

1,55

1,50

1,45

1,40

1,35

1,30

1,25

1,20

DeA Capital

LPX 50

FTSE All

(**) Source: Bloomberg.

For further info:

section: Investor Relations

DeA Capital - Annual Financial Statements to 31 December 2013

19

The performance of the DeA Capital

share

The share prices recorded in 2013 are shown

The Company’s share price declined by 55.2%

below.

between 11 January 2007, when DeA Capital

S.p.A. began operations, and 31 December 2013.

(in EUR per share)

2013

In the same period, the FTSE All-Share® and

Maximum price

1.48

LPX50® fell by 52.2% and 26.7% respectively.

Minimum price

1.24

The DeA Capital share fell by 5.2% in 2013, while

Average price

1.35

the Italian market index FTSE All-Share® rose by

Price at 31 December 2013

1.27

17.6%, and the LPX50® gained 30.3%. In 2013,

the share’s liquidity was higher than in 2012, with

average daily trading volumes of around 120,000

(EUR million)

31 December 2013

shares.

Market capitalisation*

389

(*) capitalisation net of own shares: EUR 348 million.

Investor Relations

DeA Capital S.p.A. maintains stable and

In December 2008, the DeA Capital share joined

structured relationships with institutional and

the LPX50® and LPX Europe® indices.

individual investors. In 2013, as in previous

The LPX® indices measure the performance of

years, the Company has continued with its

the major listed companies operating in private

communication activities, including attendance

equity (Listed Private Equity or LPE). Due to its

at the STAR Conference, held in Milan in March

high degree of diversification by region and type

2013. In addition to one-to-one meetings with

of LPE investment, the LPX50® index has become

institutional investors, a presentation was also

one of the most popular benchmarks for the LPE

held on this occasion, to illustrate in detail new

asset class. The method used to constitute the

developments relating to the subsidiary IDeA

index is published in the LPX Equity Index Guide.

FIMIT SGR. In September, the Company met with

For further information please visit the website:

institutional investors in Paris and in October

attended the STAR Conference in London. During

on the GLPE Global Listed Private Equity Index,

the year the Company also held meetings and

the index created by Red Rocks Capital, a US

conference calls with institutional investors,

asset management company specialising in

portfolio managers and financial analysts from

listed private equity companies. The index was

Italy and abroad.

created to monitor the performance of listed

private equity companies around the world and is

Coverage of the DeA Capital stock is currently

composed of 40 to 75 stocks.

carried out by Equita SIM and Intermonte

For more information: www.redrockscapital.com

SIM, the two main intermediaries on the

(GLPE Index).

Italian market, with Intermonte SIM acting as

a specialist. The research prepared by these

The website is the primary mode of contact for

intermediaries is available in the Investor

investors, who may choose to subscribe to a

Relations section of the website www.deacapital.it.

For further info:

section: Investor Relations

20 DeA Capital - Report on Operations

mailing list and send questions or requests for

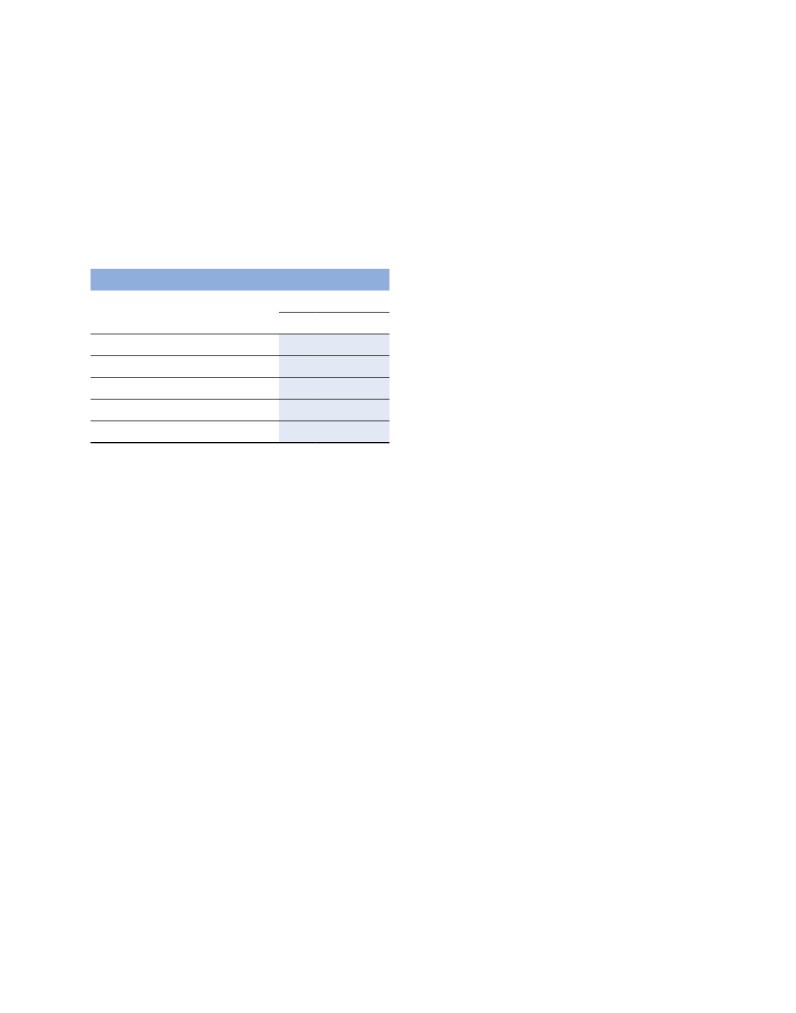

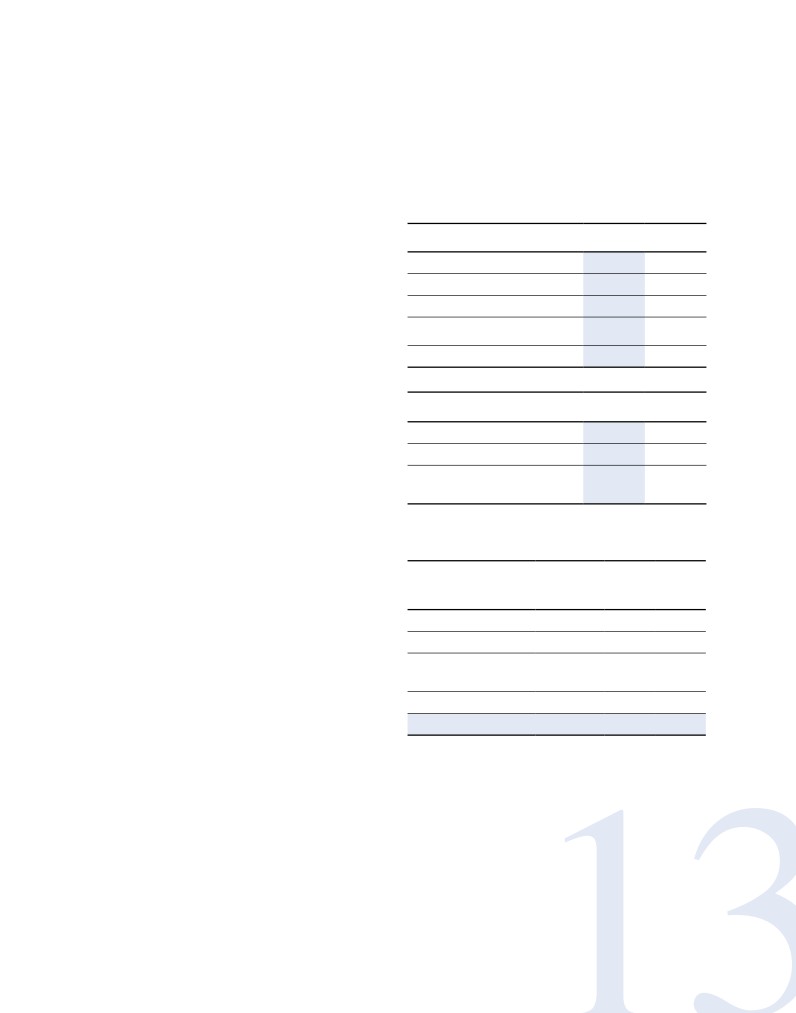

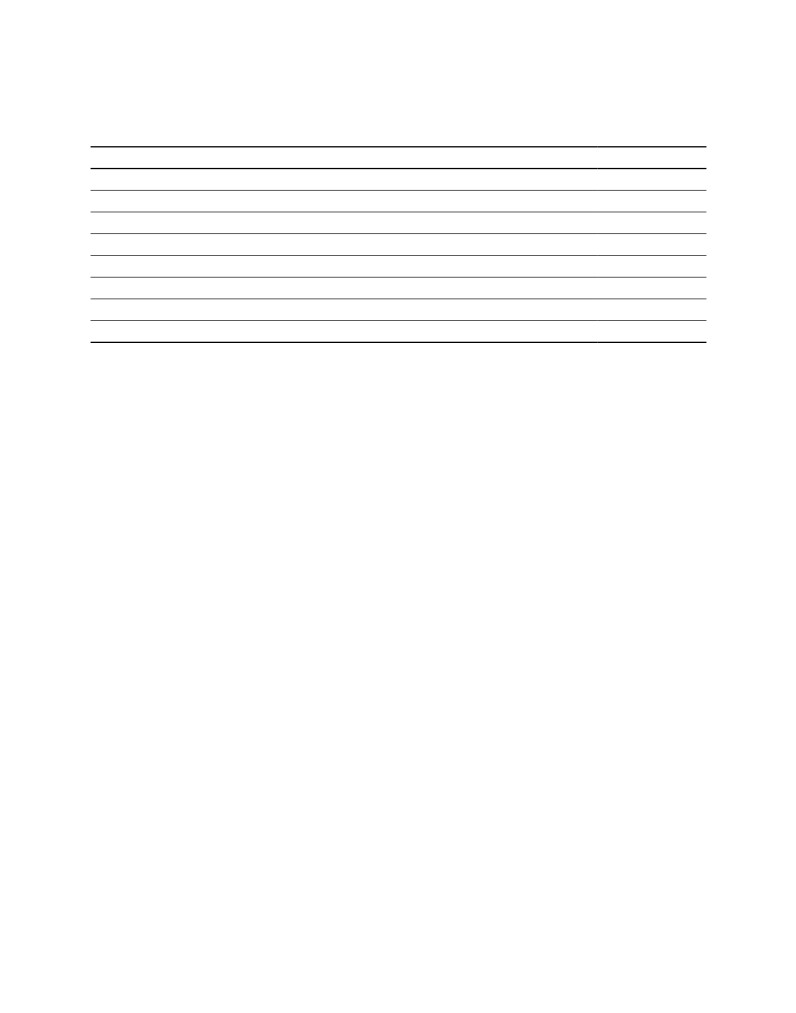

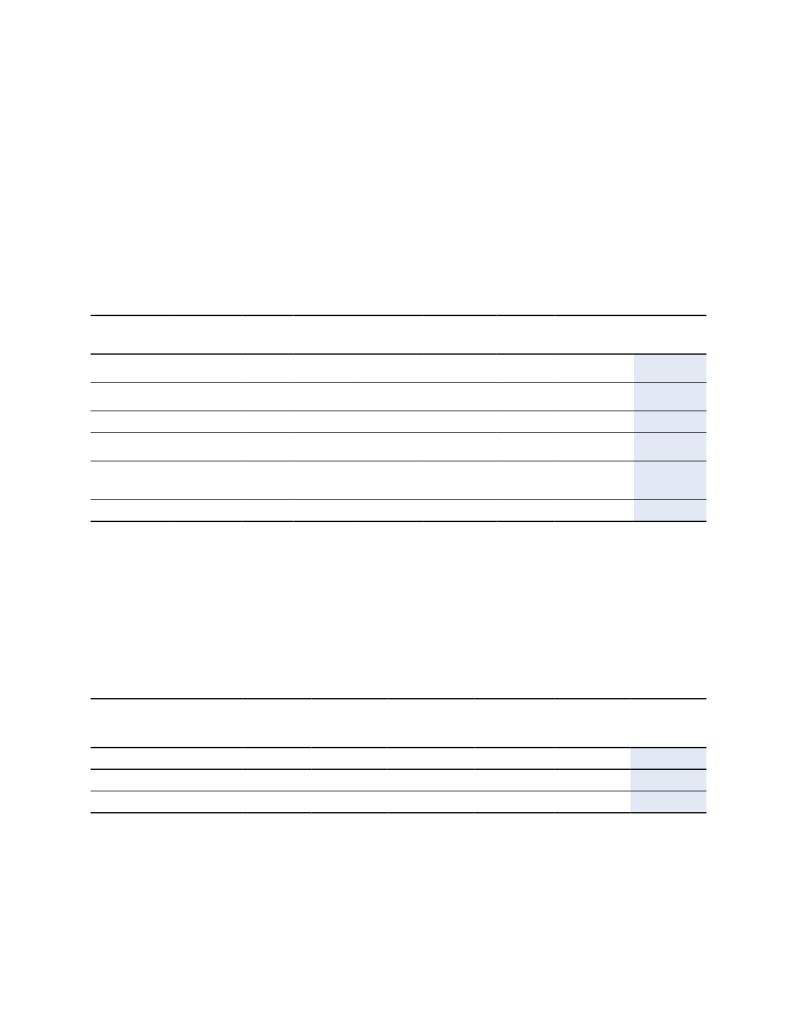

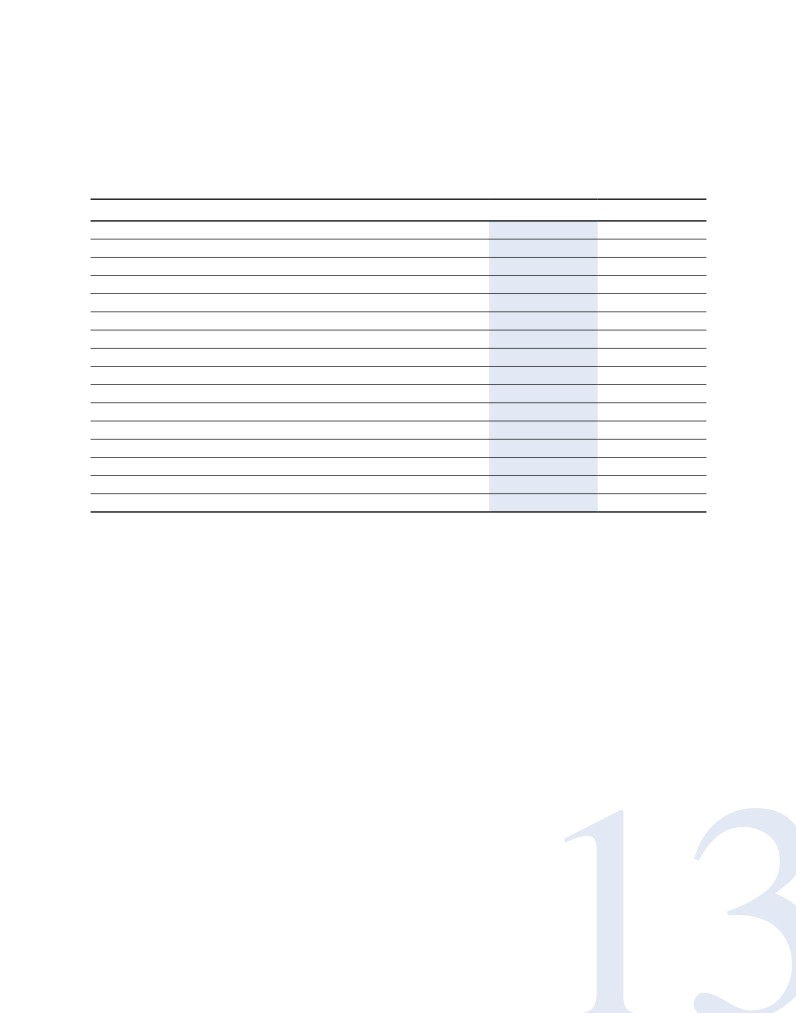

3. The DeA Capital Group’s

information and documents to the Company's

key Statement of Financial

Investor Relations area, which is committed to

Position and Income

answering queries promptly, as stated in the

Investor Relations Policy published on the site. A

Statement figures

quarterly newsletter is also published for investors

to keep them updated on the main items of news

The DeA Capital Group’s key income statement and statement

of financial position figures to 31 December 2013 are shown

on the Group, and analyse the Group’s quarterly

below, compared with the corresponding figure to

results and share performance. The mobile site,

31 December 2012.

stakeholders a further tool with which to access

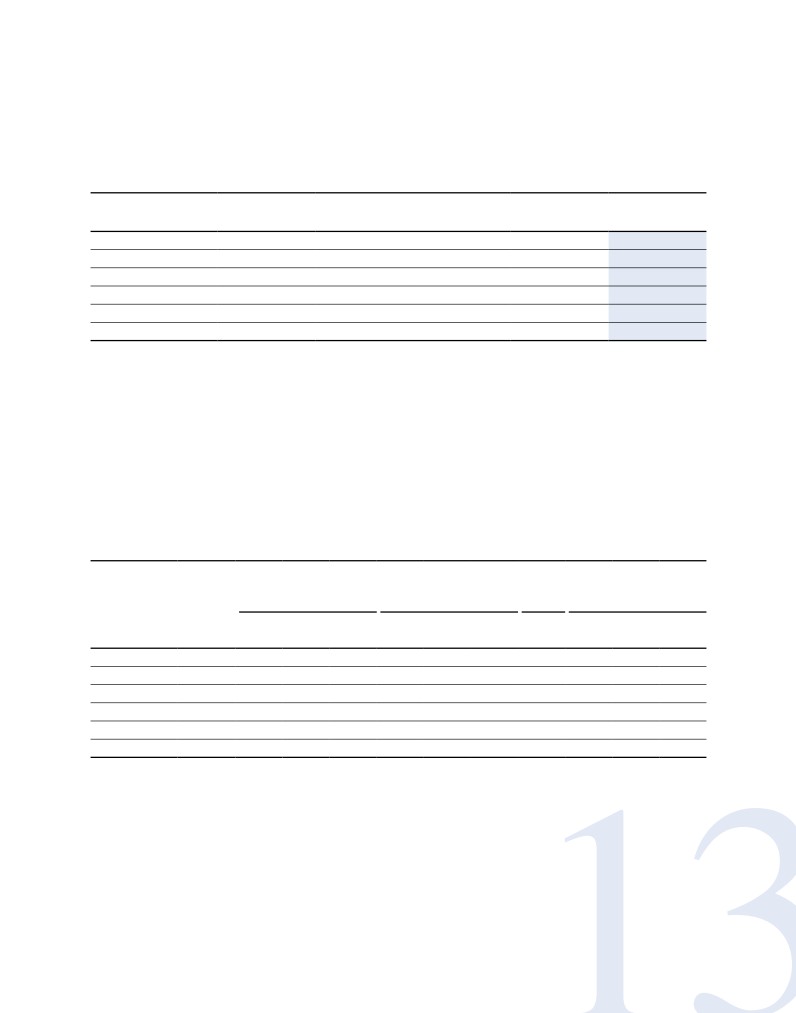

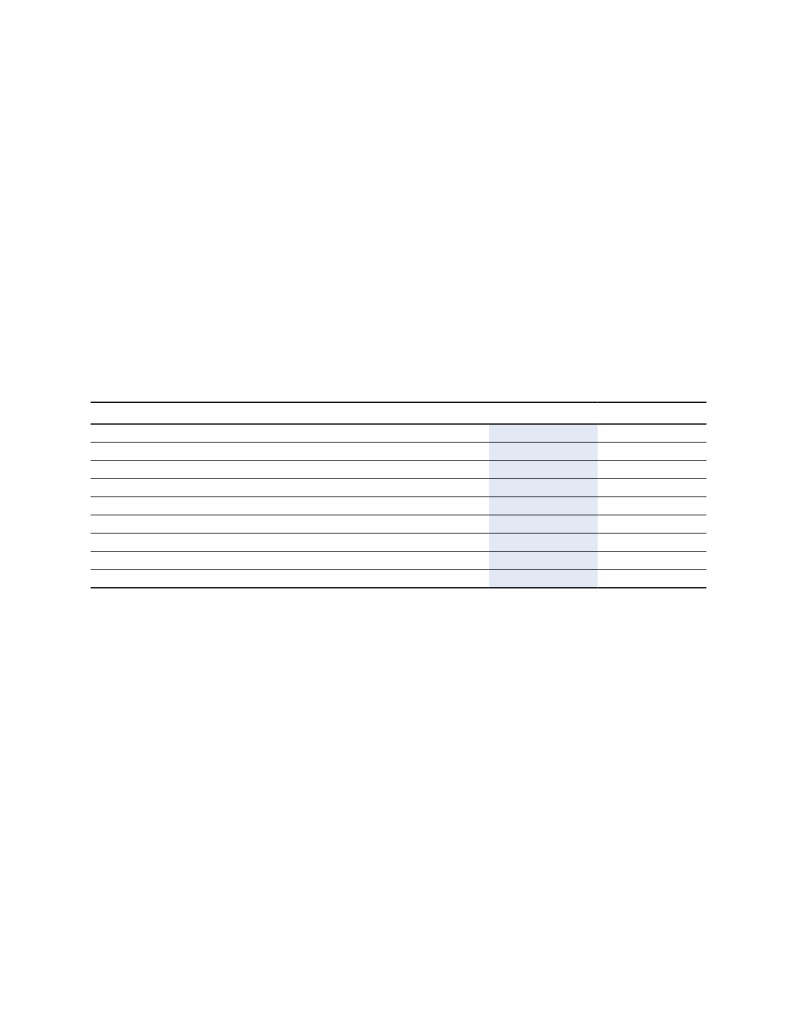

December December

key information about the DeA Capital Group via

(EUR million)

31,2013

31,2012

their mobile phone or smartphone.

NAV/share (EUR)

2.30

2.60

Since July 2013, DeA Capital has strengthened

Group NAV

629.5

723.1

its presence on social networks: it has a profile

Investment portfolio

762.0

873.1

on Linkedin, appears on Slideshare with the most

Net financial position - Holding

recent of its key presentations to institutional

Companies

(138.7)

(141.6)

investors, and has an entry in Wikipedia. DeA

Net financial position consolidated

(127.7)

(123.6)

Capital is therefore continuing with its intention to

strengthen its presence on the web and to make

information for stakeholders available through

Year

Year

(EUR million)

2013

2012

many channels.

Parent Company net profit/(loss)

62.9

2.3

Group net profit/(loss)

(31.1)

(26.3)

Comprehensive income

(Group share)

(Statement of Performance - IAS 1)

(94.3)

62.5

The table below shows the change in the NAV during 2013.

Value

Change in

No.

per

Group NAV

Total value

Shares

share

(EUR m)

(m)

(€)

Group NAV at 31.12.12

723.1

274.6

2.63

Purchase of own shares

(0.9)

(0.6)

1.40*

Other comprehensive

income - Statement of

Performance - IAS 1

(94.3)

Other movements of NAV

1.6

Group NAV at 31.12.13

629.5

274.0

2.30

(*) Average price of purchases in 2013.

DeA Capital - Annual Financial Statements to 31 December 2013

21

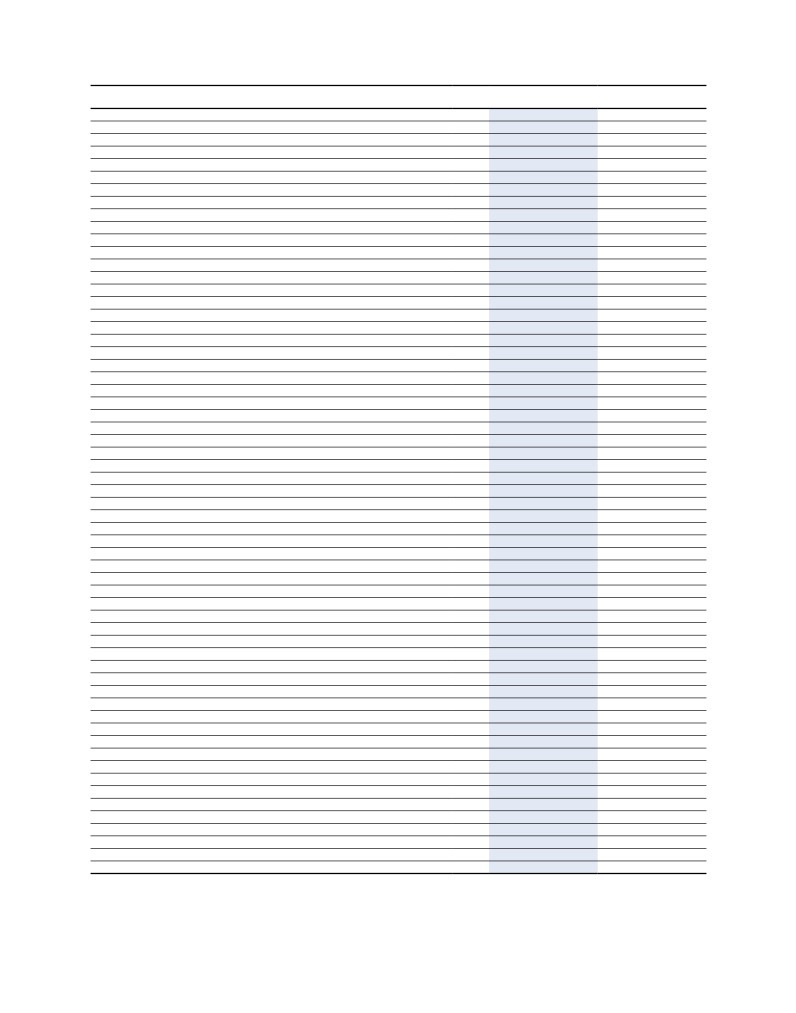

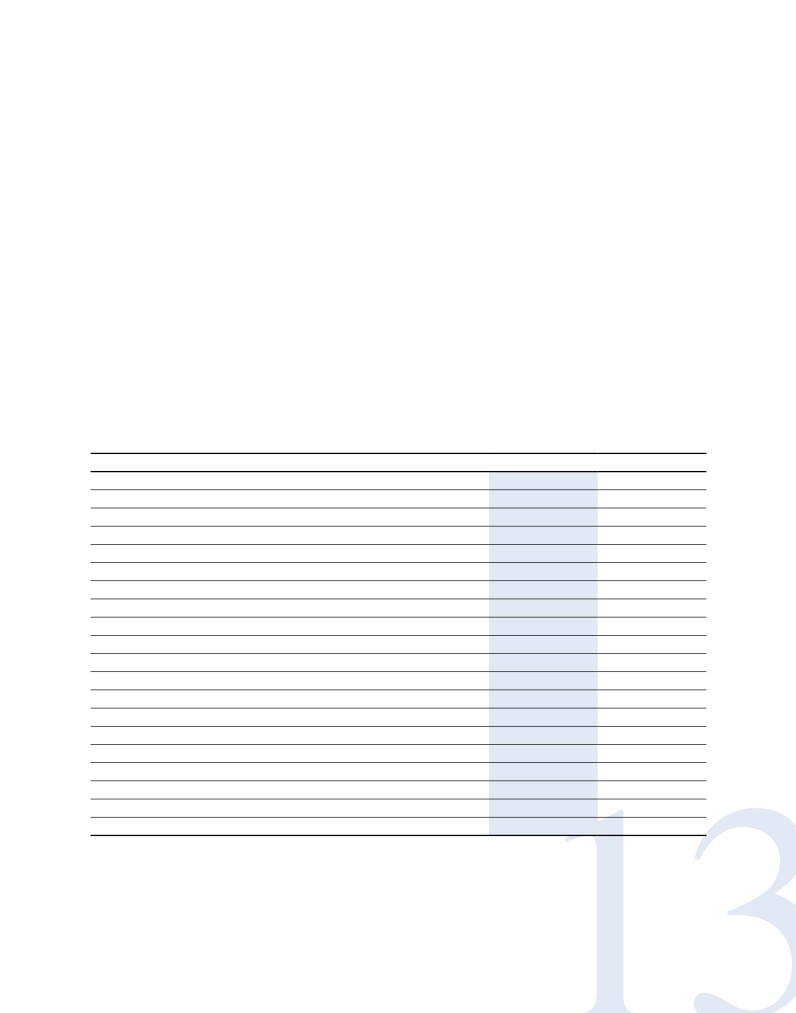

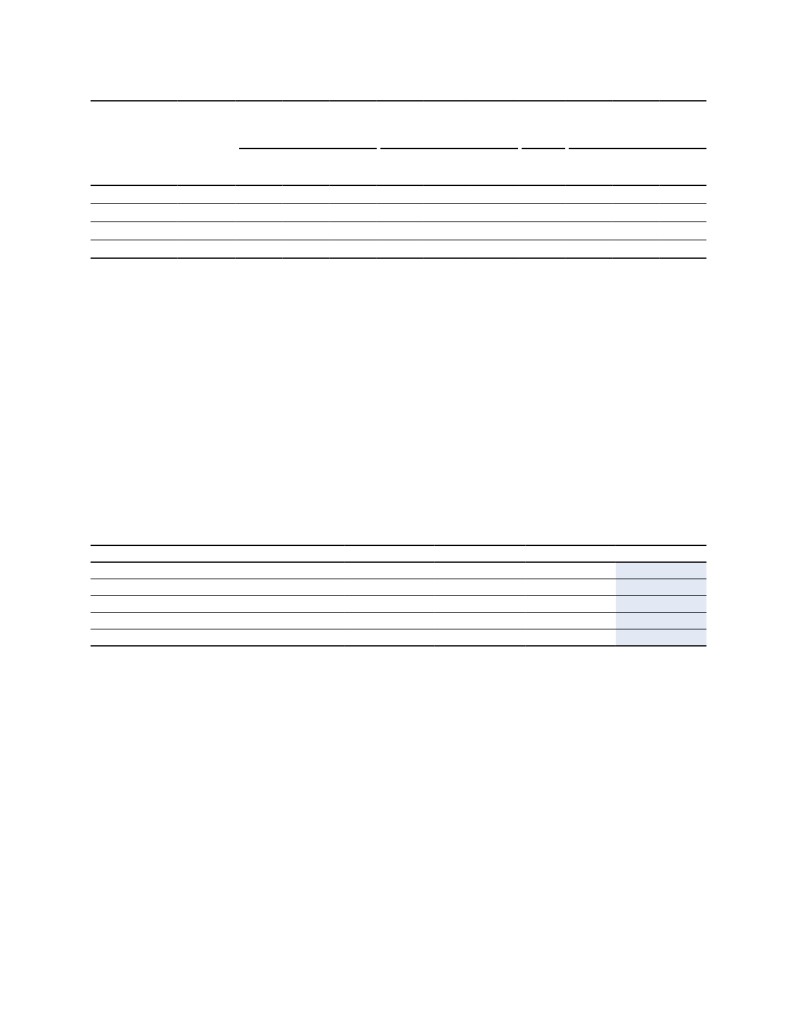

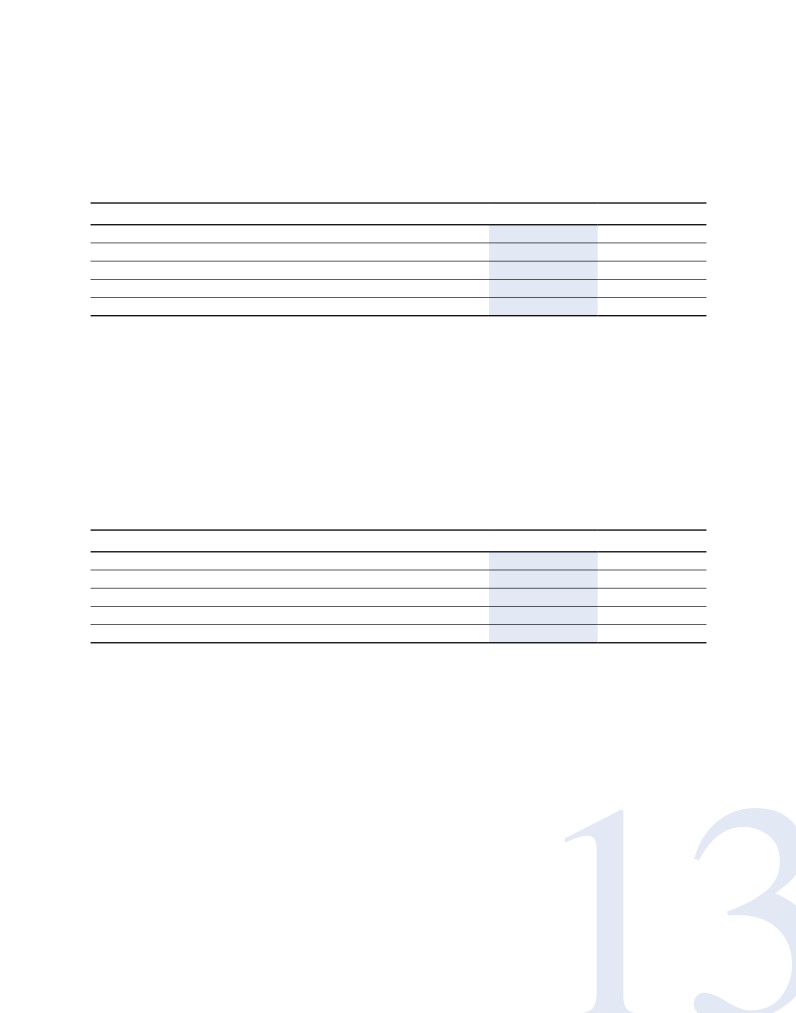

The table below provides details of the Group’s Net Asset Value at 31 December 2013.

December 31,2013

December 31,2012

M€

% NIC €/Share

M€

% NIC

€/Share

Private Equity Investment

- Santè / GDS

221.2

29%

0.81

226.1

26%

0.82

- Kenan Inv. / Migros

132.4

17%

0.48

223.6

26%

0.81

- Funds- Private Equity / Real Estate

191.3

25%

0.70

180.8

21%

0.66

- Other (Sigla,..)

13.6

2%

0.05

15.0

2%

0.05

Total PEI (A)

558.5

73%

2.04

645.5

75%

2.34

Alternative Asset Management

- IDeA FIMIT SGR

145.5

19%

0.53

168.5

19%

0.61

- IDeA Capital Funds SGR

51.8

7%

0.19

53.8

6%

0.20

- IRE / IRE Advisory

6.2

1%

0.02

5.3

1%

0.02

Total AAM (B)

203.5

26%

0.74

227.6

26%

0.83

Investment Portfolio (A+B)

762.0

99%

2.78

873.1

101%

3.17

Otehr net assets (liabilities)

6.2

1%

0.02

(8.4)

-1%

(0.02)

NET INVESTED CAPITAL ("NIC")

768.2

100%

2.80

864.7

100%

3.15

Net Financial Debt Holdings

(138.7)

-18%

(0.50)

(141.6)

-16%

(0.52)

NAV

629.5

82%

2.30

723.1

84%

2.63

4. Significant events during

Loan agreement with Mediobanca - use

of the revolving line

the year

The significant events that occurred in 2013 are reported

In 2013, DeA Capital S.p.A. made net use of a further EUR

below.

20 million of its revolving credit line with Mediobanca - Banca

di Credito Finanziario S.p.A., bringing its overall exposure to

Private equity funds - paid calls/

EUR 120 million as of 31 December 2013.

distributions

Note that the above-mentioned lines are due to be repaid

In 2013, the DeA Capital Group increased its investment in the

via a single payment on 16 December 2015, although DeA

IDeA I FoF, ICF II, IDeA OF I and IDeA EESS funds following

Capital S.p.A. has the option to make full or partial early

total payments of EUR 24.5 million (EUR 5.9 million, EUR 8.0

repayment.

million, EUR 7.8 million and EUR 2.8 million respectively).

At the same time, the DeA Capital Group received capital

Purchase of 30% of IDeA SIM shares

distributions totalling EUR 22.9 million from the IDeA I FoF,

and subsequent liquidation of the

ICF II, IDeA OF I funds (EUR 20.3 million, EUR 2.1 million and

company

EUR 0.5 million respectively) to be used in full to reduce the

carrying value of the units.

On 25 February 2013, in compliance with the provisions of

various agreements reached with the former CEO of IDeA SIM,

In terms of net cash outlay, the IDeA EESS completed the

DeA Capital S.p.A. acquired the shares he held in IDeA SIM,

fourth and final closing on 12 April 2013, reaching the stated

equal to 30% of the company’s capital, bringing its stake

commitment target of EUR 100 million, with the DeA Capital

to 95%.

Group subscribing to a further commitment of EUR 2.5 million,

taking its total commitment in the fund to EUR 15.3 million.

Subsequently, on 11 April 2013, the shareholders’ meeting of

IDeA SIM voted to convert the company and rename it IDeA

Consulenza S.r.l., and at the same time put it into liquidation.

The shareholders’ meeting that approved the liquidation was

held on 3 September 2013.

22 DeA Capital - Report on Operations

Purchase of a further shareholding

Appointment of new Corporate Bodies

in IDeA FIMIT SGR

On 19 April 2013, the shareholders’ meeting of DeA Capital

On 27 February 2013, DeA Capital S.p.A. signed an

S.p.A. appointed the Company’s new Board of Directors

agreement with Inarcassa to acquire shares from the latter

and the new Board of Statutory Auditors, which will remain

representing 2.98% of the capital of IDeA FIMIT SGR; financial

in office for the three-year period until the approval of the

equity instruments issued by IDeA FIMIT SGR and held by

financial statements to 31 December 2015.

Inarcassa are excluded from the sale.

At the end of the shareholders’ meeting, the new Board of

The transaction was closed on 29 April 2013, once the pre-

Directors met to appoint Paolo Ceretti as the Chief Executive

emptive rights had expired. As a result of this, together with

Officer, and to vest the Chairman (Lorenzo Pellicoli) and the

other purchases, the DeA Capital Group’s total stake in IDeA

Chief Executive Officer with the necessary powers.

FIMIT SGR rose to 64.30%.

The Board of Directors also adopted resolutions relating to

corporate governance, and appointed independent director

IRE capital increase

Rosario Bifulco as Lead Independent Director. Furthermore,

it decided not to create a specific appointments committee,

On 19 March 2013 and 17 July 2013, the shareholders'

but to attribute its functions to the Remuneration and

meetings of IRE approved, respectively:

Appointments Committee, for which the related operating

regulations have been approved. The Board appointed

• a capital increase reserved for the company’s CEO, for

directors Severino Salvemini, Francesca Golfetto and Rosario

a stake of 3.75% in the company, against a payment of

Bifulco to the Remuneration and Appointments Committee,

approximately EUR 151 thousand, equal to a pro-rata

with Rosario Bifulco as chairman, and appointed Rosario

portion of the shareholders’ equity;

Bifulco, Francesca Golfetto and Severino Salvemini to the

• the issue of special shares, with limited economic rights,

Control and Risks Committee, with Severino Salvemini as

reserved for the company’s CEO, for 10% of the company.

chairman.

Lastly, the Board of Directors confirmed the appointment of

Dividends from Alternative

Lorenzo Pellicioli, the Chairman of the Board of Directors,

Asset Management

as the executive director responsible for monitoring the

effectiveness of the internal control and risk management

On 27 March 2013, the shareholders' meeting of IRE

system, and appointed Gian Piero Balducci (Chairman),

approved the company's financial statements to 31 December

Davide Bossi (Internal Audit) and Severino Salvemini to the

2012 and voted to pay out dividends (paid on 10 May 2013)

Supervisory Body pursuant to Legislative Decree 231/2001 for

totalling EUR 2.3 million, including EUR 2.2 million to the DeA

the period 2013-2015.

Capital Group.

On 16 April 2013, the shareholders’ meeting of IDeA Capital

Share buy-back plan

Funds SGR approved the company’s financial statements to

31 December 2012 and voted to pay dividends totalling EUR

On 19 April 2013, the shareholders’ meeting authorised the

4.4 million entirely to DeA Capital S.p.A. The dividend was

Board of Directors to buy and sell, on one or more occasions,

paid on 22 April 2013.

on a rotating basis, a maximum number of ordinary shares

in the Company representing a stake of up to 20% of share

On 17 April 2013, the shareholders’ meeting of IDeA FIMIT

capital.

SGR S.p.A. approved the company’s financial statements to 31

December 2012 and voted to pay out dividends totalling EUR

The plan replaced its predecessor approved by the

15.6 million (paid on 9 May 2013), including around EUR 10.0

shareholders’ meeting on 17 April 2012 (which was scheduled

million to the DeA Capital Group (taking account of the stake

to expire on 17 October 2013) and will pursue the same

actually held on the dividend payment date).

objectives as the previous plan, including the purchase of

own shares to be used for extraordinary transactions and

In summary, dividends paid during 2013 by the Alternative

share incentive schemes, to offer shareholders a means of

Asset Management business to the DeA Capital Group's

monetising their investment, to stabilise the share price and to

holding companies totalled EUR 16.6 million

regulate trading within the limits of current legislation.

(EUR 15.0 million in 2012).

The authorisation specifies that purchases may be carried

out up to the date of the shareholders’ meeting to approve

DeA Capital - Annual Financial Statements to 31 December 2013

23

the financial statements to 31 December 2013, and in any

allocated at EUR 1.289, which is the arithmetic mean of the

case not beyond the maximum duration allowed by law,

official price of ordinary DeA Capital shares on the Mercato

in accordance with all the procedures allowed by current

Telematico Azionario, the Italian screen-based trading system

regulations, and that DeA Capital may also sell the shares

organised and managed by Borsa Italiana S.p.A., on the

purchased for the purposes of trading, without time limits.

trading days between 19 March 2013 and 18 April 2013.

The unit price for the purchase of the shares will be set on a

case-by-case basis by the Board of Directors, but must not

The shareholders’ meeting of 19 April 2013 also approved a

be more than 20% above or below the share’s reference price

paid capital increase, in divisible form, without option rights,

on the trading day prior to each purchase. In contrast, the

via the issue of a maximum of 2,000,000 ordinary shares to

authorisation to sell own shares already held in the Company’s

service the DeA Capital S.p.A. Stock Option Plan for

portfolio, and any shares bought in the future, was granted

2013-2015.

for an unlimited period, to be implemented using the methods

considered most appropriate and at a price to be determined

The shareholders’ meeting also approved the adoption of the

on a case-by-case basis by the Board of Directors, which must

Performance Share Plan for 2013-2015. On the same date,

not, however, be more than 20% below the share's reference

in implementation of the shareholders’ resolution, the Board

price on the trading day prior to each individual sale (apart

of Directors of DeA Capital S.p.A. voted (i) to implement the

from in certain exceptional cases specified in the plan).

DeA Capital S.p.A. Performance Share Plan for 2013-2015

approved by the shareholders’ meeting, vesting the Chairman

On the same date, the Board of Directors voted to launch

of the Board of Directors and the Chief Executive Officer with

the plan to buy and sell own shares authorised by the

all the necessary powers, to be exercised severally and with

shareholders’ meeting, and to this end vested the Chairman of

full power of delegation; and (ii) to allocate a total of 393,500

the Board of Directors and the Chief Executive Officer with all

units (representing the right to receive ordinary shares in

the necessary powers, to be exercised severally and with full

the Company free of charge, under the terms and conditions

power of delegation.

of the plan) to certain employees of the Company, of its

subsidiaries and of the Parent Company De Agostini S.p.A.

In 2013, DeA Capital S.p.A. purchased around 0.6 million

who carry out important roles for the Company.

shares valued at about EUR 0.9 million (at an average price of

EUR 1.40 per share).

The shares allocated due to the vesting of units will be drawn

from the own shares already held by the Company so that the

Taking into account purchases made in previous years for

allocation will not have a nominally dilutive effect.

plans in place at the time, and uses of own shares to service

purchases relating to the alternative asset management

The shareholders’ meeting also approved the Company’s

business, at 31 December 2013 the Company owned

Remuneration Policy pursuant to art. 123-ter of the Testo

32,637,004 own shares (equal to about 10.6% of the share

Unico della Finanza law.

capital).

Stock option and performance

share plans

On 19 April 2013, the shareholders’ meeting approved

the DeA Capital S.p.A. Stock Option Plan 2013-2015. To

implement the resolution of the shareholders’ meeting, the

Board of Directors voted (i) to implement the DeA Capital

S.p.A. Stock Option Plan for 2013-2015 approved by the

shareholders’ meeting, vesting the Chairman of the Board of

Directors and the Chief Executive Officer with all the necessary

powers, to be exercised jointly or severally and with full power

of delegation; and (ii) to allocate a total of 1,550,000 options

to certain employees of the Company, its subsidiaries and the

Parent Company De Agostini S.p.A. who carry out important

roles for the Company.

In line with the criteria specified in the regulations governing

the DeA Capital S.p.A. Stock Option Plan for 2013-2015, the

Board of Directors also set the exercise price for the options

24 DeA Capital - Report on Operations

Sale of the stake held in Alkimis SGR

First closing of the IDeA Crescita

Globale (global growth) fund

On 11 July 2013, after obtaining the necessary authorisation,

DeA Capital S.p.A. sold its entire stake (10%) in Alkimis SGR

On 5 November 2013, the Board of Directors of IDeA Capital

for around EUR 0.1 million (in line with its carrying value at

Funds SGR authorised the first closing of the newly-created

30 June 2013).

IDeA Crescita Globale fund, for a commitment of around EUR

55 million, raised with the support of a leading Italian bank's

network of financial advisors.

"Milano Santa Giulia” initiative

The objective of the IDeA Crescita Globale fund is to invest in

On 31 July 2013, the Board of Directors of Risanamento S.p.A.

both private equity funds managed by operators with a proven

voted to accept the proposal formulated by IDeA FIMIT SGR,

track record of returns and solidity - focusing mainly on the

containing guidelines for the operation relating to the “Milano

buy-out, capital growth and emerging markets sectors - and

Santa Giulia” initiative, which provides for the creation of a

directly in operating companies, by jointly investing with

fund managed by IDeA FIMIT SGR.

other funds.

The completion of the above transaction depends on the

conditions precedent set out in the agreement being met,

Sale by subsidiary Générale de Santé

including, in particular, the finalisation of the necessary

of its psychiatric activities

agreements relating to the contribution, IDeA FIMIT SGR

obtaining the necessary financing on the Fund’s behalf, and

On 18 December 2013, Générale de Santé finalised the sale

the absence of impediments associated with the seizure order

of its psychiatric division (Medipsy), which has a turnover

currently in place for part of the real estate area.

of around EUR 150 million and 29 clinics in France, to the

Australian group, Ramsay Health Care.

On 23 December 2013, IDeA FIMIT SGR exercised its right

to extend the deadline for the binding offer until 31 March

Following this transfer and the sale of four rehabilitation

2014. On this date, should one or more of the conditions

centres, Générale de Santé has completed its plan to

precedent not be met, the parties will be free of all obligations

focus once again on medicine, surgery, obstetrics and the

arising from the acceptance of the new binding offer.

rehabilitation clinics included in the geographical centres in

which the Group is organised.

Purchase of Colliers business division

The combined operations had a beneficial effect of around EUR

200 million on the subsidiary’s net financial position.

On 16 October 2013, the subsidiary Innovation Real Estate

S.p.A. (IRE) purchased the business division of Colliers Real

Estate Services Italia S.r.l. (Colliers) relating to its property,

facility, project management and technical property services

activities (e.g. due diligence, regularisation etc.) against

payment in newly-issued IRE shares and the entry of Colliers

into the share capital of IRE in various phases.

Specifically, Colliers was granted a 3% stake in the share

capital of IRE in exchange for the transfer of the business

division.

Once two years from the date of the transfer have elapsed,

and subject to the achievement of the results set out in the

business plan of the division in question, Colliers will be

granted a further 3% stake in IRE.

The parties also agreed that should the business division post

a considerable overperformance, Colliers will be granted a

further 2% stake in IRE via the placement of another tranche

of the capital increase in cash (at nominal value).

DeA Capital - Annual Financial Statements to 31 December 2013

25

5. The results of the DeA Capital

restrict the credit market and increase the cost of capital. In

most of the emerging economies, domestic demand proved

Group

to be weaker than forecast, in contrast to foreign demand

from the advanced economies and China.

Consolidated results for the period relate to the operations of

the DeA Capital Group in the following businesses:

The financial markets were significantly influenced by

the quantity of liquidity injected into the global “system”.

• Private Equity Investment, which includes the reporting units

Volatility in the US and Europe abated slightly, and the main

involved in private equity investment, broken down into

international equities markets recorded positive returns (in

equity investments (Direct Investments) and investments in

local currency): in 2013, indices were therefore positive in

funds (Indirect Investments).

the US (29.6% for the S&P 500 and 38.3% for the NASDAQ)

and in Japan (56.7% for the NIKKEI 225). In Europe, the

• Alternative Asset Management, which includes reporting

gap between the peripheral countries, such as Italy (16.6%

units involved in asset management activities and related

for the FTSE MIB) and Spain (21.4% for the IBEX), and the

services, with a current focus on the management of private

central countries, such as Germany (25.5% for the DAX 30)

equity and real estate funds.

and France (18% for the CAC 40) narrowed significantly.

In the emerging countries, returns in local currency varied

Private Equity

widely in 2013: +2% in Russia, +9% in India, - 5.5% in

Brazil and -6.7% in China.

Global economic growth accelerated in the second half of

In terms of global indices, bond markets recorded a

2013, and a further improvement is expected in 2014 and

marginally negative return in 2013, due mainly to the

2015, mainly on the back of the recovery in the advanced

contribution of the US, which accounts for around 50% of

economies. However, there are still downside risks associated

the total. In Italy, however, the bond market recorded a

with the fragile situation in some countries.

positive return across all maturities, due to the reduction

in the country risk; the yield spread on ten-year treasury

In the US, the huge injections of liquidity by the Fed -

certificates fell in comparison with their German bund

together with low interest rates - have proved effective

counterparts, as did the default risk measured by the five-

in bolstering the economy. In Japan, too, expansionary

year credit default swap (CDS), which closed at 219 and 168

monetary policy combined with fiscal policy stimulus

bps respectively.

packages has generated positive effects on growth; the

devaluation of the yen triggered by such measures has

In general terms, the risks threatening the outlook for global

also helped. In China, despite the restrictive measures

economic recovery have not changed; these include the high

implemented by the government and central bank to prevent

unemployment level and the instability that could affect the

the development of property bubbles, total loans increased

financial and currency markets, especially in the emerging

substantially on the back of interest rates that are lower than

countries, following the end of expansionary monetary policy

the historical average. In the eurozone, however, the ECB

in the US. Added to these factors, there is the risk associated

did not introduce new monetary stimuli, and lending fell for

with the effects of very low inflation, especially in the

the fifth year running in most EU countries. This hampered

eurozone, which increases the burden of public debt in real

economic growth and hence made it difficult for employment

terms. In Europe, more sustained growth will be necessary

levels to rise.

to rebalance the public accounts; the ECB will therefore have

to adopt further longer-term expansionary monetary policy

The IMF’s latest estimates forecast growth of 3.7% in the

measures to stimulate lending and hence domestic demand.

global economy in 2014. Specifically the advanced economies

Moreover, it is essential that the banks are recapitalised and

are expected to experience growth of 2.2% (2.8% for the US

banking union is achieved through the centralisation of both

and 1% for the eurozone) and emerging economies growth

the supervisory and crisis management functions.

of 5.1%. In the US, domestic demand is expected to drive

growth, supported partly by the reduction in the tax burden.

However, signs of improvement in the macroeconomic

In the eurozone, the recession is giving way to recovery, albeit

environment continue to materialise. As an example, a

at different speeds in the various countries, thanks especially

recent update to the Composite Leading Indicator, the super-

to exports rather than public and consumer spending, which is

index developed by the OECD to assess growth prospects,

hampered by high levels of public and private debt.

showed an improvement in most of the advanced economies,

including the entire eurozone, especially Italy and France.

In China, the improvement recorded in the second half

In addition, rating agency Moody’s recently confirmed Italy’s

of 2013, mainly on the back of investment, will remain

creditworthiness at Baa2, while upgrading its outlook from

temporary to some extent, as a result of the measures to

negative to stable.

26 DeA Capital - Report on Operations

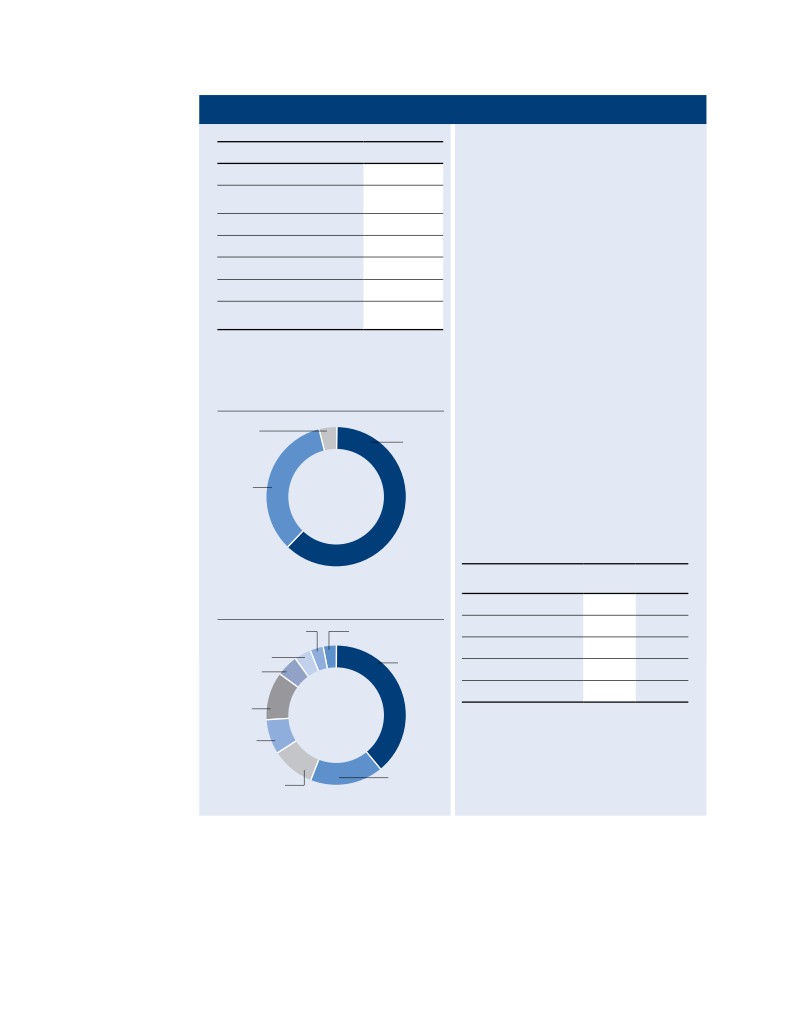

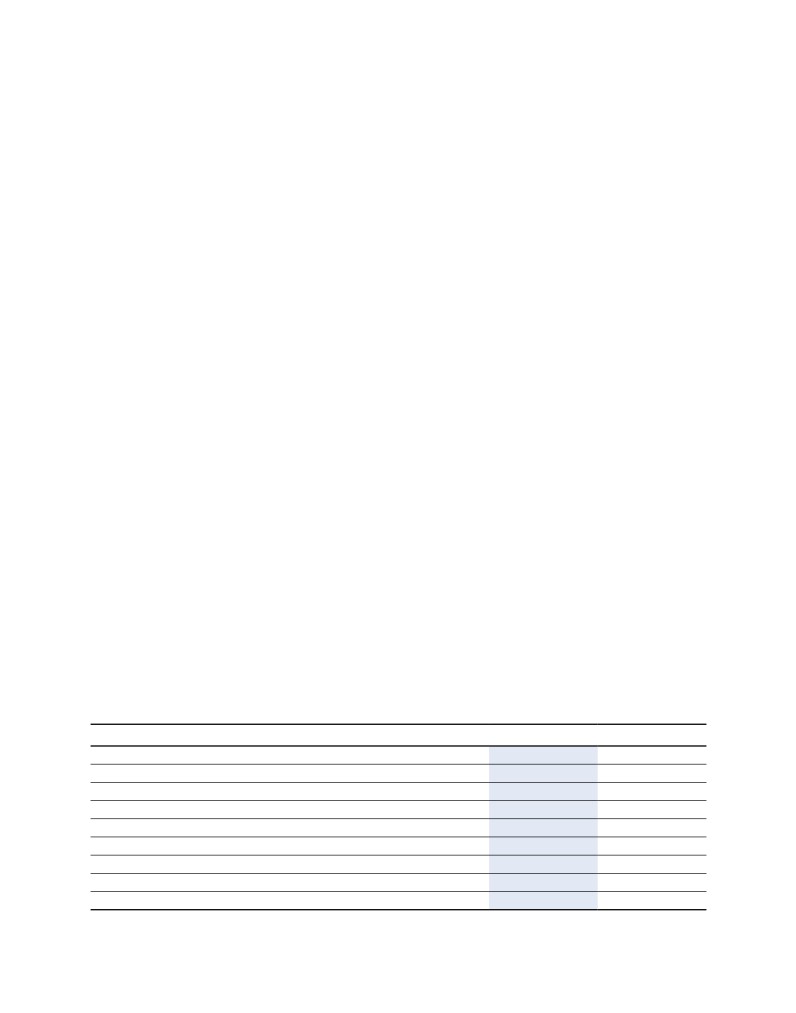

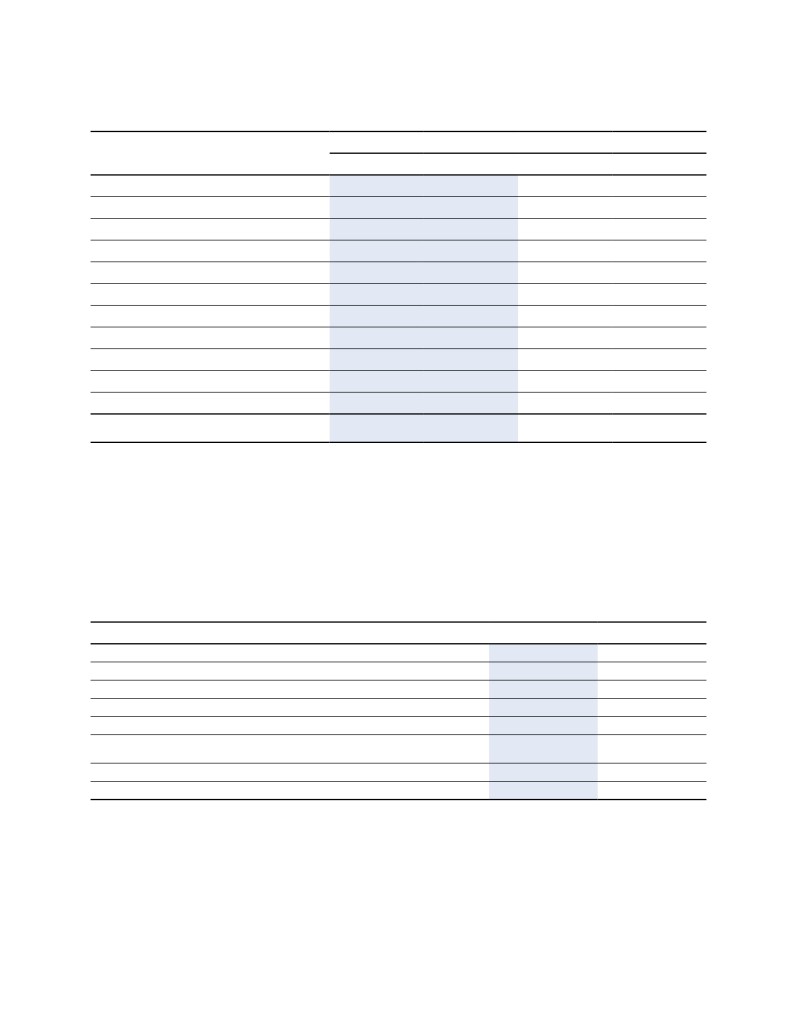

Investment prospects and the outlook for

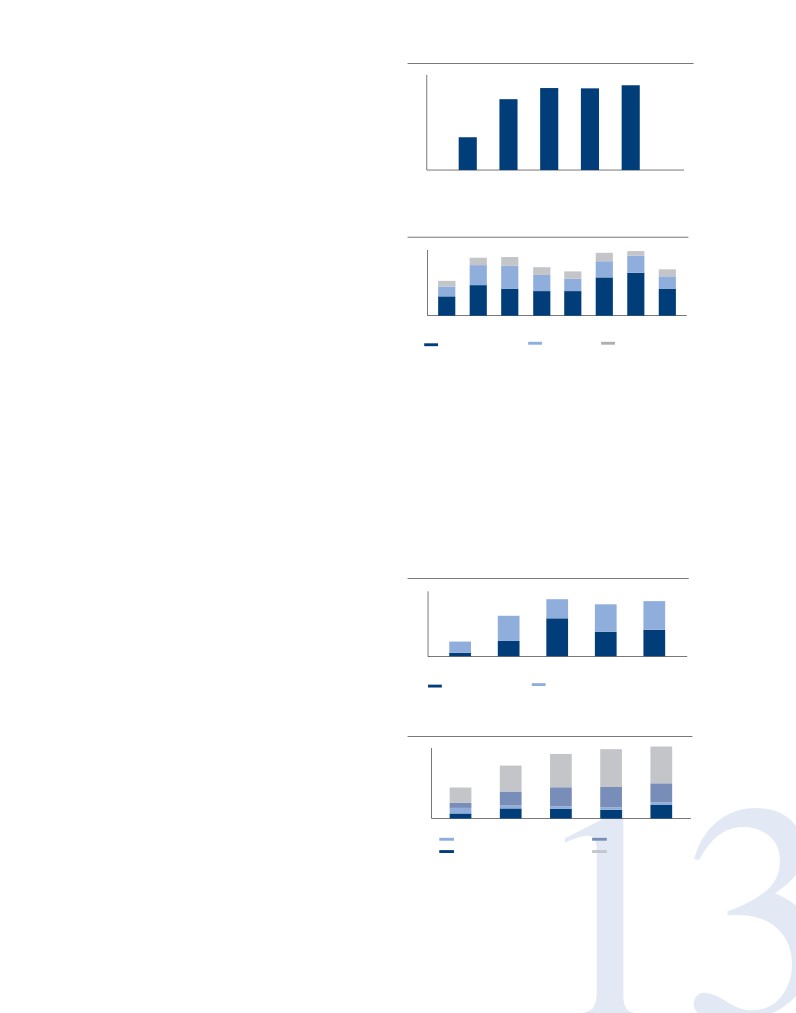

Global value of investments in buy-outs (USD billion)

the European and global private equity

300

274

265

264

markets

250

229

Expectations that 2013 would be a positive year for the

200

private equity industry, expressed at the outset of the year,

150

106

were borne out by an increase in distribution flows, funds

100

raised and allocations to the asset class. Continuing low

50

interest rates increasingly drove investors to pursue returns.

0

2009

2010

2011

2012

2013

This is reflected in a particularly healthy high-yield debt

Source: Preqin

market, in which it was possible to finance new transactions

and refinance the capital structure, with the resulting

Global value of investments in buy-outs, by region

distributions to investors. Disposals of the best companies

(USD billion)

in the funds’ portfolios were also supported by a general

155

159

160

143

145

7%

13%

increase in the level of exit multiples.

13%

15%

120

120

109

27%

114

16%

26%

15%

86

35%

16%

80

17%

39%

28%

33%

28%

There have been a number of important new developments

28%

40

in the relevant regulatory framework and in the industry's

55%

53%

46%

51%

56%

61%

66%

57%

0

public profile in the US and Europe. In the US, as a result

1S

2S

1S

2S

1S

2S

1S

2S

2010

2010

2011

2011

2012

2012

2013

2013

of the Jobs Act, the SEC has eased some of the restrictions

North America

Europe

Asia and rest

on the offer of private equity funds to the public. This will

of the world

Source: Preqin

probably result in greater efforts to market retail products

by the large management companies with consolidated

structures that are better suited to responding to the

Investment increased compared with 2012 (+4%). However,

demands of a large database of limited partners. In Europe,

the trend is the exact opposite of that seen in 2012: the

the Alternative Investment Fund Managers Directive

second half of 2013 saw a reduction in investment levels.

(AIFMD), which imposes limits on fundraising from European

It is possible that activity has declined due to a more

investors by non-European managers, came into force in

cautious approach by managers in response to higher

July 2013. The effects of this legislation further restrict

prices. In geographical terms, investment growth has

European investors’ ability to access the best non-EU

been driven by activity in the US, supported mainly by the

private equity managers, who will have fewer opportunities

availability of low-cost credit with covenant-lite or covenant-

to market their funds in Europe.

free structures. The situation in Europe is broadly stable

compared with 2012.

The relationships between fund managers (FMs) and

Volume of disinvestments of buy-out funds

investors (LPs) have continued - albeit with a few

(USD billion)

exceptions - to move in favour of LPs. The level of

350

313

303

sophistication of investors has paved the way for some

285

300

250

222

33%

necessary changes in the industry. The search for

52%

200

53%

better returns is reflected in the desire to minimise fees

150

62%

81

100

67%

as a proportion of the fund’s performance. Most FMs

77%

47%

48%

50

38%

23%

have noticed that LPs are very keen to enter into joint

0

2009

2010

2011

2012

2013

investments, which are usually offered without management

2nd Half

1st Half

and performance fees. Moreover, the trend to reduce

Source: Preqin

management fees, driven by the collection of larger funds or

funds with more economies of scale, is continuing.

Number of disinvestments of buy-out funds

1,299

1,348

1500

1,210

1200

992

51%

51%

55%

900

49%

578

600

49%

26%

27%

30%

29%

300

16%

3%

19%

5%

4%

4%

17%

19%

15%

12%

19%

0

2009

2010

2011

2012

2013

Restructuring

Sale to GP

IPO

Trade Sale

Source: Preqin

DeA Capital - Annual Financial Statements to 31 December 2013

27

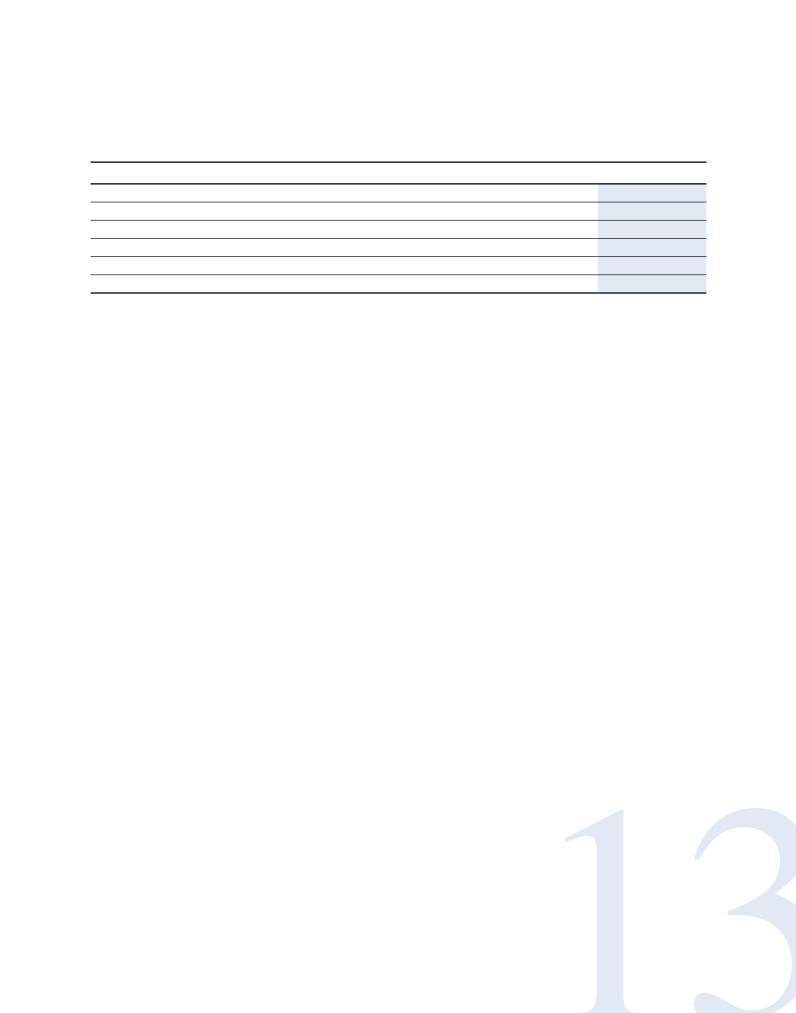

Global capital calls and distributions of PE funds (USD billion)

Disposals also showed an upward trend, increasing by 6%

from 2012 to 2013. This trend accelerated in the second half

100

82

of 2013, which gives rise to positive expectations for the

80

68

67

66

current year. The positive performance of the financial markets

58

57

57

58

60

re-opened a window for IPOs, which represented nearly

48

49

46

43

20% of exits by number in 2013. Secondary buy-out activity

40

35

decreased, and was probably hampered by high prices.

23

20

Global PE fundraising (USD billion)

0

468

1S2010 2S2010 1S2011 2S2011

1S2012 2S2012 1S2013

500

Capital calls (US$ Mld)

Distributions (US$ Mld)

382

400

320

331

Source: Thomson Venture Economics

295

300

200

As shown in figure 7, in the first half of 2013 and the whole

of 2012, distributions considerably exceeded capital calls at

100

global level. In view of the exit figures, we expect the same

0

performance in the second half of 2013 and for 2014, as the

2009

2010

2011

2012

2013

markets are relatively stable.

Source: Preqin

It is also possible to detect a number of investment themes

Global PE fundraising by region (USD billion)

associated with the current uncertain situation:

120

320

295

331

382

468

100

• in Europe, investment opportunities are concentrated in

ROW

15%

14%

25%

27%

23%

80

transactions involving SMEs in peripheral countries (Italy

EU

28%

23%

20%

22%

25%

and Spain), which are at a discount compared with prices in

60

other markets. Moreover, the regulatory and deleveraging

40

63%

NA

processes of the credit institutions will constitute a significant

57%

55%

52%

53%

20

opportunity for private credit and distressed debt funds;

0

• in the US, the traditional activities of buying medium-sized

2009

2010

2011

2012

2013

to large companies using loans, and restructuring company

Source: Preqin

processes or balance sheets, are continuing. Managers

with strong operating and company turnaround skills are

2013 was a good year for fundraising. Higher inflows,

in an advantageous position. In addition, managers able to

associated with a reduction in the number of funds collected,

offer loan capital to middle-market companies that are not

signify an increase in the average size of funds compared

financed by traditional sources are operating in a particularly

with 2013. The increase in inflows was mainly due to two

favourable environment;

factors: (i) the rising level of distributions, which implies

• lastly, emerging markets are likely to continue to be the

a reduction in investors' exposure, and (ii) an increase

main driver of global growth, albeit at a slower pace than

in allocations to private equity resulting from the higher

in recent years. The recent fall in public market valuations,

value of public equity (the “denominator effect”) generated

along with the depreciation of the respective currencies

by the financial markets’ good performances. Conversely,

and the continuation of the growth trend in domestic

fundraising in emerging countries, which fell by 25%, lost out

consumables, will enable managers focusing on these

to the more developed markets. The lower inflows associated

markets to obtain particularly attractive buying conditions.

with a reasonable level of valuations leads us to believe that

there are good prospects for investment in the next few

quarters in those geographical areas.

Private equity in Italy

The increase in global inflows involves a general rise in dry

Statistics provided by the Italian Association of Private Equity

powder (liquidity to be invested), which, in tandem with the

and Venture Capital (AIFI), and currently updated to the first

availability of debt, helps keep prices high. All of this augurs

half of 2013, show an increase in inflows compared with the

well for the continuation of the sell-offs of the more mature

same period in 2012. Capital raised by independent operators

portfolios in 2014.

on the market totalled EUR 162 million (a fall of 40% on the

first half of 2012).

The number of new investments increased to 161, with a total

value of EUR 1,407 million, i.e. a rise of 10% on the same

28 DeA Capital - Report on Operations

period in 2012. In value terms, the bulk of the resources

165% on 2012) and Milan (up 123% on 2012), while in the

invested, in line with previous years, went into buy-out

main markets of the core countries, investment remained

transactions, which attracted EUR 923 million, equivalent to an

more or less stable with good performances reported by

80% rise on the same half in the previous year.

London (up 94%) and Munich (up 86%)3.

Looking at the number of transactions, early stage,

with 65 investments, was in first place, having overtaken

expansion (+18%).

Real Estate in Italy

Turning to disinvestments, 65 investments were sold in the first

After a poor year in 2012, the worst year for property

half of 2013, an increase of 48% on the same period in 2012.

investment since the introduction of the euro, in 2013

The amount disinvested, calculated at historical acquisition cost,

institutional investors rediscovered an interest in the area,

totalled EUR 1,106 million, compared with EUR 141 million in

especially in retail property.

the first half of 2012 (+683%).

Institutional non-residential investment, including purchase

transactions completed via the transfer of units in property

Real Estate

funds, totalled around EUR 4.7 billion in 2013 (approximately

EUR 2.6 billion in 2012); of this, some EUR 2 billion

Real Estate in Europe

constituted investment in the retail sector, with the bulk of this

concentrated in the fourth quarter of the year.

Direct institutional investment in non-residential European

real estate in the fourth quarter of 2013 was EUR 53.4 billion,

In 2013, foreign investors, which are looking with increasing

up 46% quarter-on-quarter and 19% year-on-year. For the

interest at Italy thanks to the better returns offered,

full year 2013, investment came to EUR 153.9 billion, up 21%

represented 72% of the total, and showed a keen interest, in

compared with 20121.

particular, in purchases of large-scale retail products: shopping

centres, retail parks and factory outlet centres4. This positive

Although the main core countries in Europe, such as the

trend is likely to continue in 2014, thanks to the adjustment to

UK, Germany and France, continued to record good results,

the prices recorded, especially secondary assets.

the peripheral countries achieved the highest investment

growth in 2013. The positive signs were mainly apparent in

The geographical distribution of investments continued to be

commercial sales and purchases in Italy and Spain, which

concentrated in Milan and Rome. The volume of investment in

more than doubled their volume of investment compared with

commercial real estate in Milan and Rome grew significantly in

2012. In 2013, Italy and Spain combined represented 6.7%

2013, to EUR 2.3 billion from EUR 1.1 billion in 2012, beating

of European investment activity, compared with 3.4% in the

the average for the last five years5.

previous year.

In the Italian market as a whole, i.e. including non-

In 2013, net investment in Europe by investors outside the

institutional sales and purchases, prices continue to erode, and

region increased, especially in the peripheral countries.

have fallen significantly since 2008. With specific reference

70% of investment in these countries was made by cross-

to the 13 main markets, prices have fallen by 16.7% for new

border investors in 2013, compared with 46% in 2009, with

builds, 17.3% for offices and 14.1% for shops6. In the second

a substantial proportion of investors coming from North

half of 2013, prices fell 2% for new builds, 2.3% for offices

America2.

and 1.9% for stores. The process of repricing, which started

with a slight lag behind the fall in sales and purchases, will

With reference to office use, a comparison of the Milan

continue for the next two years, albeit at a slower pace, before

market with the major European cities is encouraging. With

reversing in 2016.

the exception of Brussels, where there was a 186% increase in

investment compared with 2012, Milan, at 84%, outperformed

Returns in the prime segment were largely unchanged with

many of Europe's main cities, with London up 38%, Hamburg

regard both to office use (6% in Milano and 6.25% in Rome)

30%, Frankfurt 16%, Munich 4% and Paris 2%. Conversely,

and retail (5.5% for high street, a slight fall on the third

Berlin and Madrid recorded falls of 14% and 32% respectively.

quarter of 2013, and 7% for shopping centres, in both cities).

Property for retail use, on the other hand, recorded excellent

The latest figures provided by the Osservatorio sul Mercato

performances in Europe in 2013, with considerable investment

Immobiliare (OMI) of the Italian Land Agency (which include

growth in the main peripheral countries, such as Madrid (up

non-institutional operations) show that the fall in the volume

1. CBRE, European Investment Quarterly Q4 2013.

3. BNP Real Estate, Main Investment Markets in Western Europe, Q4 2013.

2 .BNP Real Estate, performance of real estate market in 10 European Tier

4. CBRE, Italy Investment Market View Q4 2013.

2 markets.

5. BNP Real Estate, Investments in Italy Q3 2013.

6. Nomisma, 3rd Report on Property Market

DeA Capital - Annual Financial Statements to 31 December 2013

29

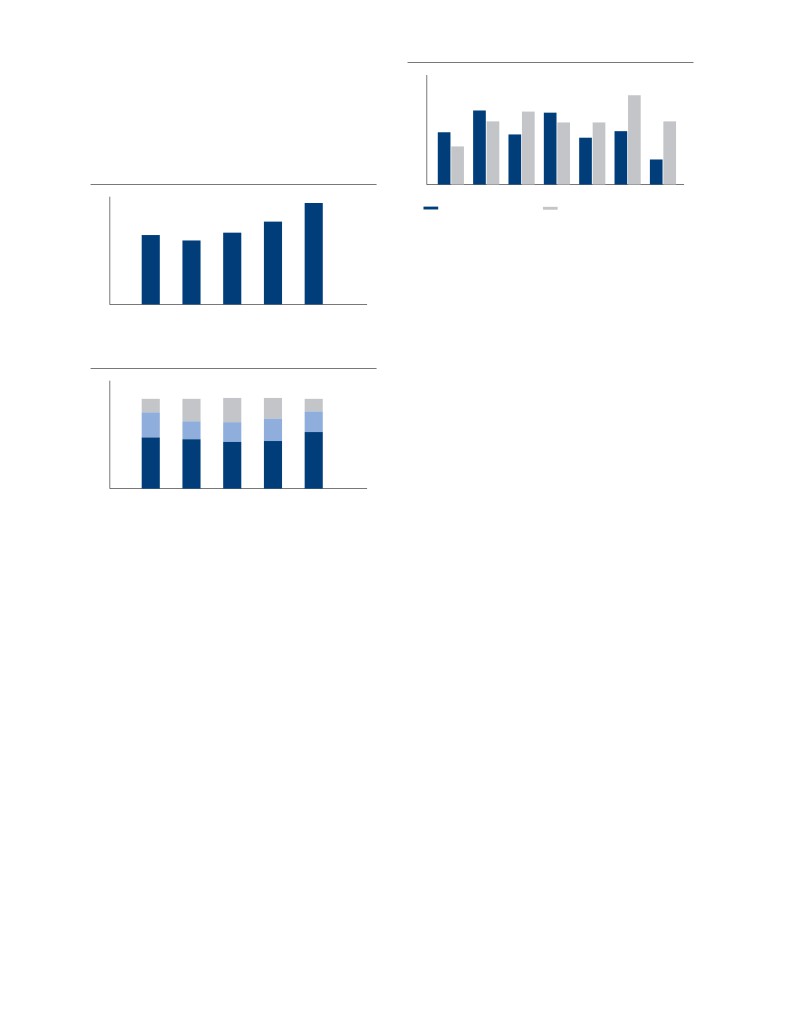

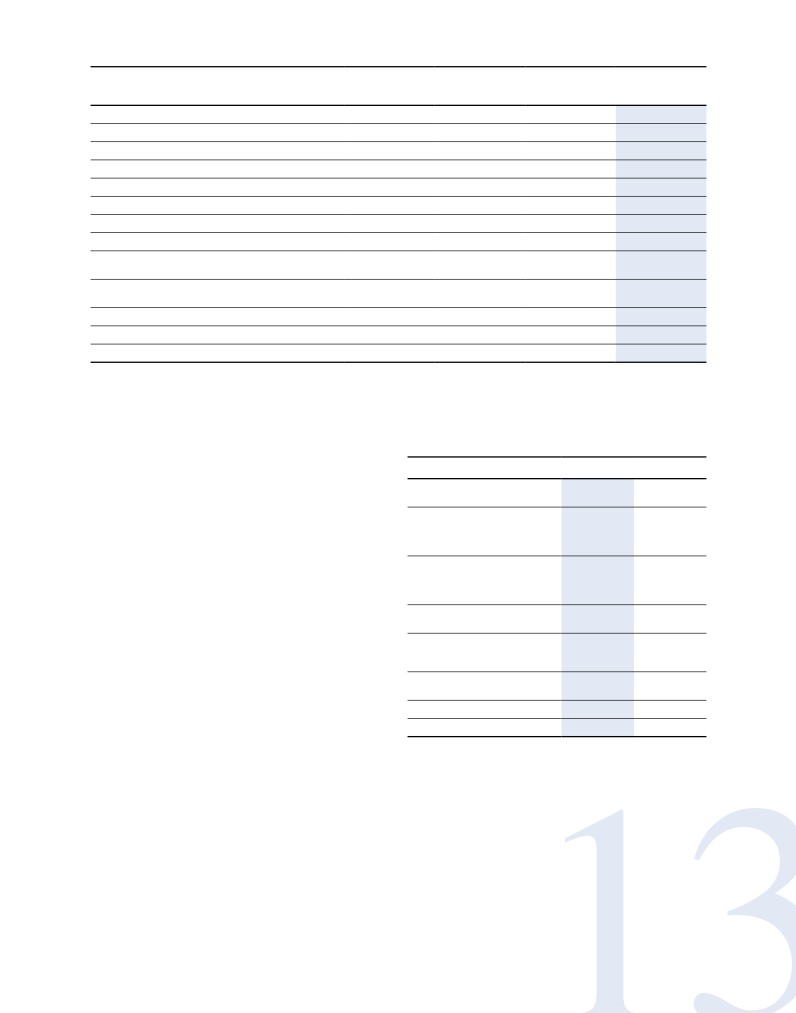

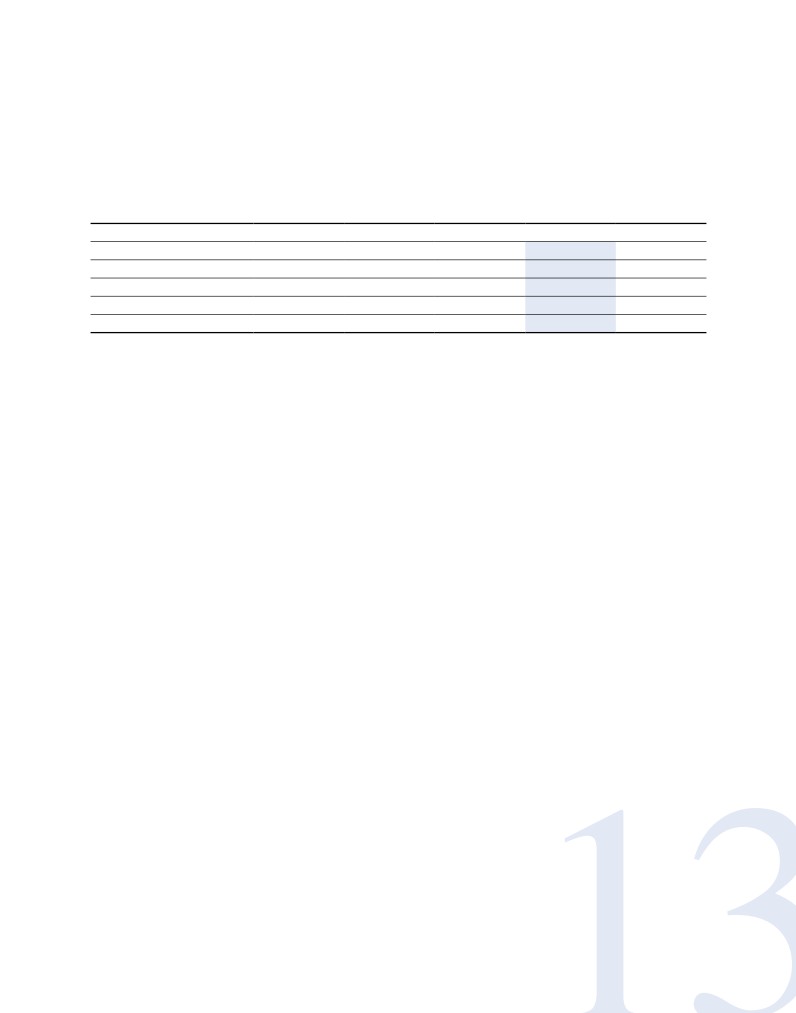

Real estate funds in Italy

of sales and purchases of real estate is slowing. In the first

three quarters of 2013, the number of transactions fell by

Estimated to total about EUR 38.3 billion, Italian real estate

13.8%, 7.7% and 6.6% respectively compared with the first

funds represent about 10.4% of European real estate funds in

three quarters of the previous year7.

terms of net assets, and in 2014 this percentage is projected

to increase to about 10.8%8. Real estate assets consisting of

Non-residential sectors also recorded significantly lower

372 property funds operating in Italy increased to EUR 49.2

volumes in the first three quarters of 2013. The biggest falls

billion, from approximately EUR 47.3 billion in December

were in the office sector, which reported a decrease of 11.7%

2012. The assets of all funds are forecast to exceed EUR 50

in the volume of sales and purchases in the third quarter,

billion in 20149.

while the commercial sector and production sector declined by

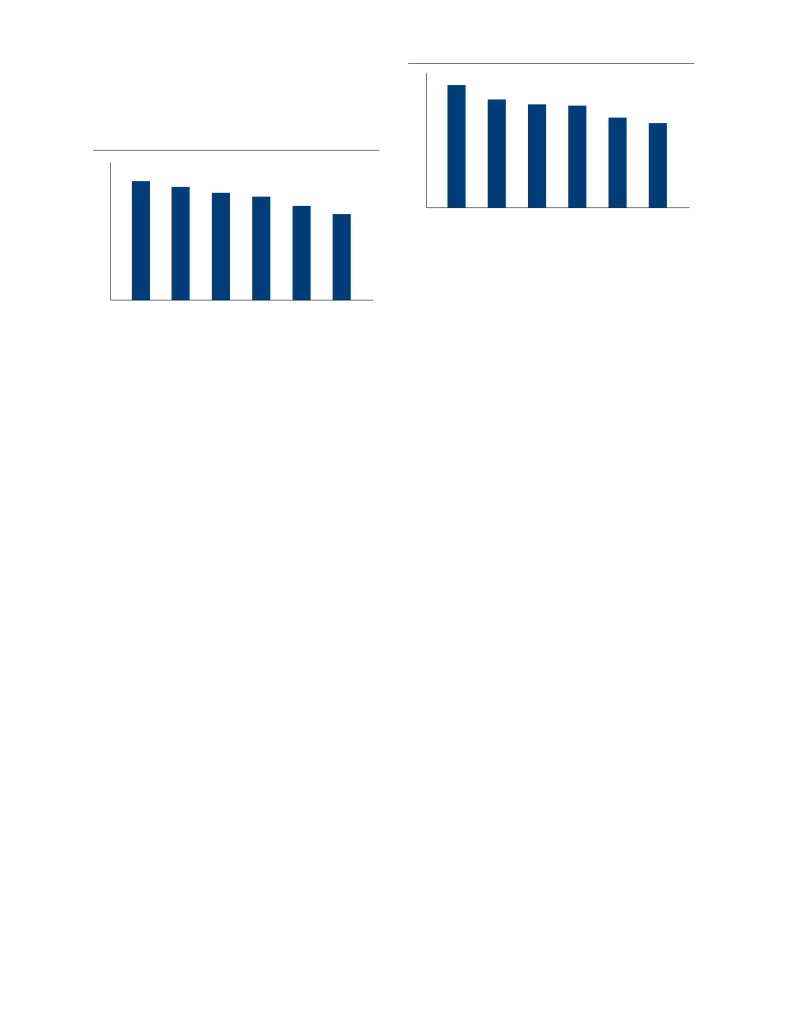

NAV of real estate funds in Italy (EUR billion)

8.2% and 9.4% respectively.

45

40

35

30

25

20

15

10

5

0

2006

2007

2008

2009

2010

2011

2012 2013E 2014E

Source: Scenari Immobiliari

The first-half 2013 report on real estate funds prepared by

Assogestioni and IPD indicates the countercyclical properties of

the Italian real estate fund market, which continues to expand

despite the adverse macroeconomic situation. Inflow in the

first half of 2013 was EUR 701 billion, while total assets were

around EUR 42 billion, an increase of 0.4% on the previous

half year (-0.5% year-on-year). The net assets of the 209 real

estate funds reviewed remained stable at about EUR 26 billion,

compared with December 201210.

7. Italian Land Agency, OMI - 3rd Quarter 2013

9. Real Estate Scenarios, Real Estate Funds in Italy and Abroad,

8. Real Estate Scenarios, Real Estate Funds in Italy and Abroad,

November 2013

November 2013

10. Amount refers only to Italian real estate funds surveyed by Assogestioni.

30 DeA Capital - Report on Operations

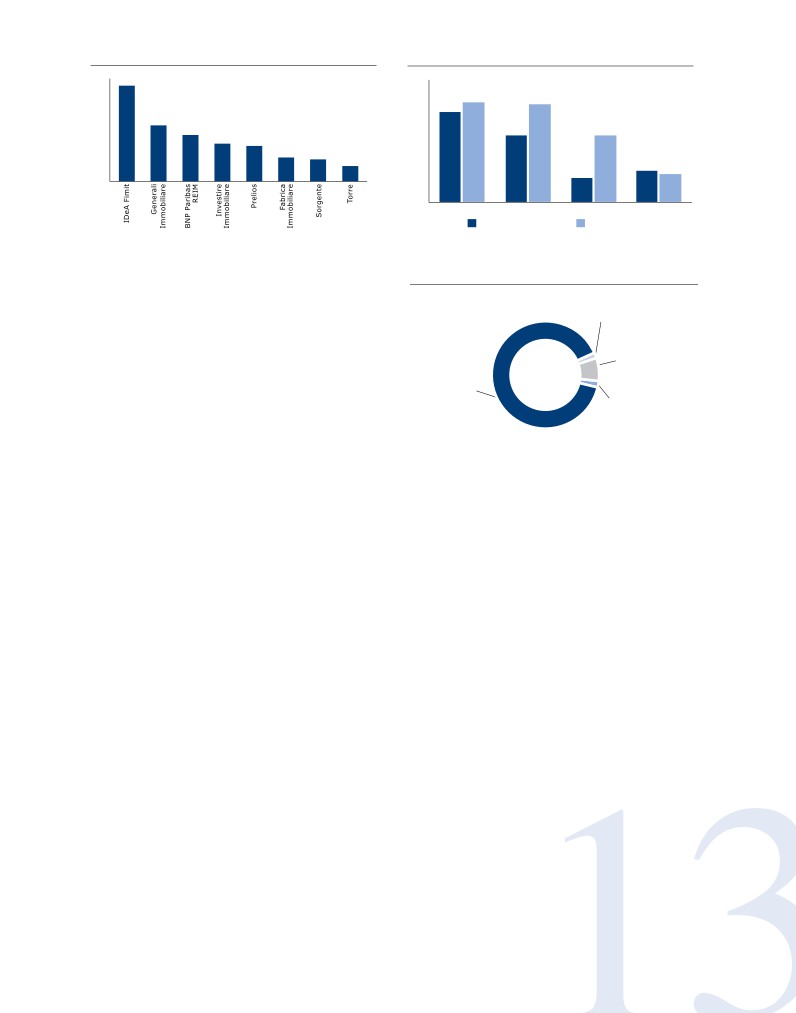

AUM of the eight largest real estate asset managers (EUR billion)

Purchases and sales (EUR billion)

10

3,0

9

8

2,5

7

6

2,0

5

4

1,5

3

2

1,0

1

0

0,5

0,0

2010

2011

2012

giu-13

Purchases

Sales

Source: Assogestioni - June 2013

During the first half of 2013, nine new funds were launched,

Allocation of assets

one of which was speculative and all of which targeted

qualified or institutional investors and were created from

1,8

%

contributions.

Shareholdings

At the end of the first half of 2013, properties and real

%

6,8

property rights made up 89.5% of the assets of the property

Transferable

funds surveyed by Assogestioni. The percentage by intended

89,5