-

Annual Report 2021

Annual Report 2021

Dear Shareholders,

In 2021, we achieved very positive results, solidifying our position on the Italian market and continuing on our development path at pan-European level, with combined assets under management reaching approximately EUR 26.5 billion.

In economic terms, revenues grew to EUR 106.5 million (integrating the amounts attributable to Quaestio Capital SGR), while the group net result saw an improvement, reaching EUR 23.8 million (compared to EUR 20.4 million recorded in 2020); in financial terms, net cash grew to EUR 135.9 million, owing to flows generated from operating and portfolio investment income.

On the basis of the above results, the proposal in effect for the remuneration of the capital invested by shareholders was also renewed this year, with a dividend of EUR 0.10 per share, or approximately 8% of the stock exchange value of DeA Capital shares at the close of 31 December 2021 (EUR 1.31 per share).

Moreover, this financial statement marks the expiry of the three-year term of the current Board of Directors. Even taking into account the period of 2019-2021, largely characterised by the Covid-19 pandemic, the results achieved have been remarkable, with significant growth observed across all the main operational metrics, a net result of over EUR 55 million and almost EUR 90 million returned to shareholders in the form of dividends.

Our Alternative Asset Management platform is unique in Italy, both in terms of size and investment strategies developed — from real estate to credit, and from private equity to multi-asset/multi-manager solutions. On this basis, we are moving forward in our international growth — the ambition being to also establish ourselves a reference partner at pan- European level.

We have always put our investors at the core of our business, with investment solutions and initiatives that are innovative, disciplined and structurally oriented towards managing risk — all supported by our usual responsible investor approach, allowing for focus to be placed on sustainable value creation over time.

It is clear that recent geopolitical and macroeconomic developments - primarily concerning the conflict between Russia and Ukraine, as well as the continued spread of Covid-19, inflation dynamics and difficulties supplying raw materials and semi-finished products - are marking a decidedly complicated frame of reference worldwide and it remains unclear how the scope thereof will unfold.

In this respect, we have already put in place the most rigorous safeguards to better deal with the most negative scenarios in relation to portfolio assets that have already demonstrated considerable resilience over the last two years of Covid-19 and a very solid balance sheet, with absolutely excellent management teams at our disposal.

Assets Under Management

| Figures in EUR | 1° Jan./31 Dec. 2021 |

|---|---|

| Maximum price | 1.41 |

| Minimum price | 1.06 |

| Average price | 1.29 |

| Price at 31 December 2021 (Eur/share) | 1.31 |

| EUR million | 31 December 2021 |

|---|---|

| Market capitalisation at 31 December 2021 | 342 |

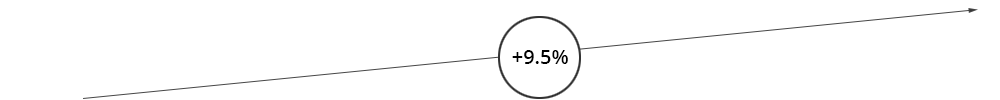

TSR - DeA Capital S.p.A.

(*) Closing date for the exit from the investment in Générale de Santé

(**) IRR basis

Download file to PDF