We are inspired by the future

We create value for our partners and communities by operating responsibly and mitigating risks, translating them into long-term opportunities and value

We keep pace with the changes affecting society and face them together with our stakeholders with whom we share the opportunities for success in the Alternative.

We grow in skills and face international challenges with a diversified investment portfolio.

We believe that the success of a business is achieved in its sustainability. And that the sustainability of a business is an indication of its success.

DeA Capital is the leading independent alternative asset management platform in Italy, with Combined AUM of € 18.0 Bln and a wide range of products and services for professional investors.

Our Platform is a choice oriented towards solid and positive growth in economic, financial and social terms.

We create value for our partners and communities by operating responsibly and mitigating risks, translating them into long-term opportunities and value

We invest in the financial well-being of our clients and in the organizational well-being of our professionals, who represent the Group’s backbone.

Through an industrial approach, a solid track record and an international footprint, we support our stakeholders in their investments with a one-stop shop strategy that is unique in Italy.

of Alternative Asset Management in Italy, with aggregate AUM of €18.0 billion

employees

alternatives which include 760 assets and 50 investee companies in the portfolio

in the main European countries

We combine different and complementary skills to offer ourselves as a single partner, with a responsible, ethical, shared one-stop shop approach.

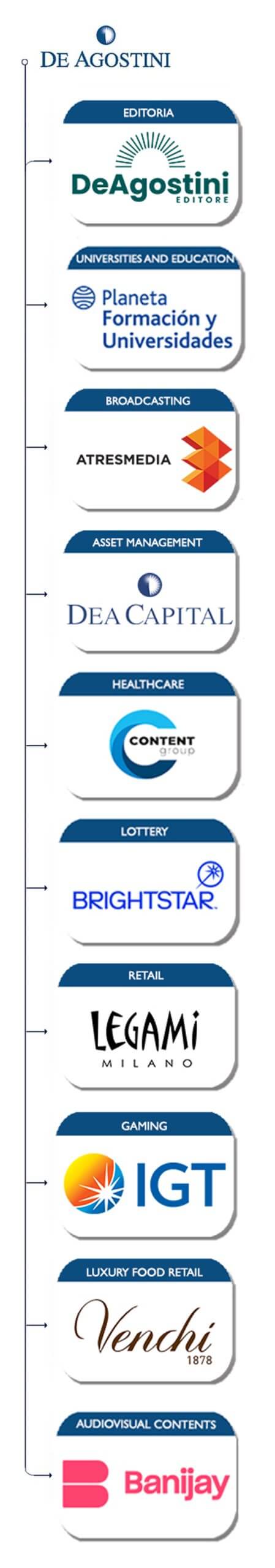

Founded in 1901 as an atlas publisher, De Agostini is now an international group with a diversified portfolio of leading companies in their respective sectors.